[co-author: Leah Adeniran]

Changing market dynamics have led buyers to assess available options to address post-closing target company issues.

Amid the buoyant market of 2021 and early 2022, compressed deal timelines and frenzied competition caused many deals to be signed with fewer buyer protections and less information about target businesses than buyers required in a different deal-making cycle. The aftermath of this M&A surge has seen a rise in post-closing discoveries of target company issues, and increasing M&A disputes, claims, and litigation — all compounded by ongoing macroeconomic and geopolitical challenges.

Rigorous, pre-closing due diligence informed by expertise, and careful negotiation of buyer protections in deal documents, remain a buyer’s best defense against the discovery of target issues (including fraud). However, acquirers suffering from “buyer’s remorse” are not without options. M&A litigation (including claims available under deal documents) is prevalent. When deal protections are limited or recourse is curtailed, we have seen buyers consider other avenues of redress, such as W&I insurance claims, and claims citing fraud. Further, detailed post-closing reviews of acquired businesses are also a growing feature of the M&A process and have proved valuable to pre-empt issues and implement improvements. However, recent deals and cases highlight that this is a delicate area that requires careful navigation and early legal advice to manage risks and avoid further damage.

Current trends in M&A disputes

Record levels of M&A activity and highly competitive deal processes resulted in more seller-friendly deal terms in many acquisition documents signed in 2021 and early 2022. This included tighter financial liability caps, shortened periods for claims, limited seller recourse, and frequent resistance to other protections, such as escrows, MAC clauses, and other provisions analysed in the Latham & Watkins Private M&A Market Study. Notwithstanding these restrictions, a wide range of M&A claims and disputes have arisen in recent months. Beyond common areas of disputes such as purchase price adjustments and earnouts, alleged breaches of warranties involving financial and operational issues are on the rise. Other recent warranty breaches claimed by buyers relate to the non-disclosure of litigation and tax liabilities, and in regulated sectors, failure to notify buyers of upcoming regulatory action.

The availability and uptake of transactional risk insurance policies (such as warranty and indemnity (W&I) insurance and tax insurance), has meant that many buyers have additional recourse. Indeed, a burst of deal activity in a seller’s market has resulted in increased claim notifications over the last couple of years, with financial statement breaches among the most commonly reported claims under W&I policies. However, per the Latham & Watkins Private M&A Market Study, only a third of buyers take out insurance policies, which can leave them with more limited options if deal documents restrict seller recourse.

Fraud unravels all

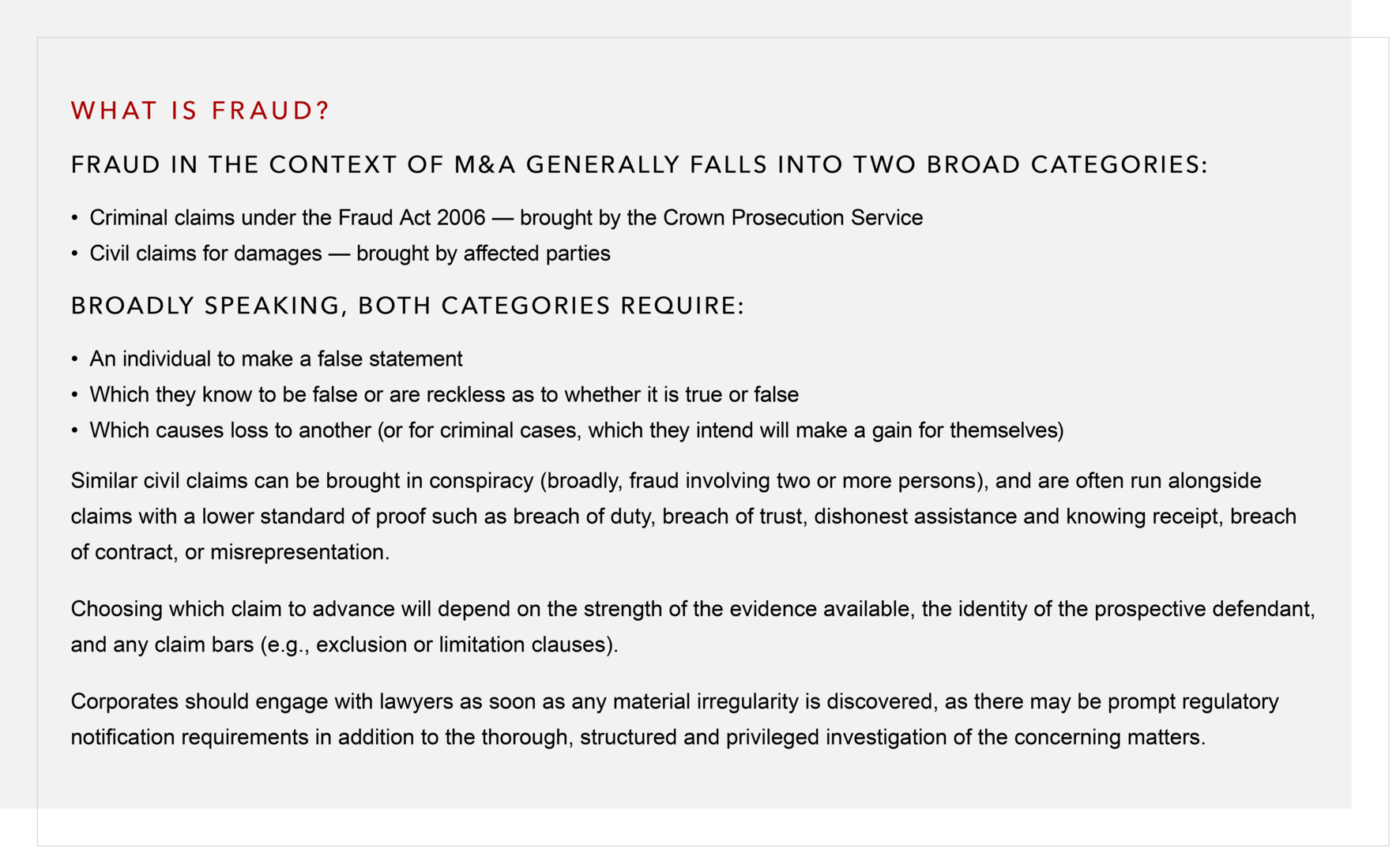

English law imposes a limited duty on sellers to disclose information and buyers must beware, and make probing diligence enquiries and receive seller statements as to the validity of matters and disclosed facts. However, instances of fraud in the context of acquisitions are not uncommon and can include allegations of artificial inflation of reported revenues, revenue growth, and gross margins or other distortions. Fraud claims can include allegations of fraudulent activity detected within a target company after closing, or buyers claiming a seller fraudulently induced them into buying the target.

Fraud is difficult to spot and even more difficult to prove — and it can have a rapid and detrimental impact on the value of an M&A deal, with fines and penalties for associated wrongdoing. The discovery of fraud between signing and closing usually gives rise to an immediate right to terminate the SPA, if it is sufficiently material. If wrongdoing is discovered after a deal has closed, there are two key reasons to claim fraud rather than breach of warranty:

- First, the remedies available for fraudulent misrepresentation are rescission of the contract (i.e., full unwinding of the contract) and/or tortious damages (with no limitation based on the remoteness of the loss from the purported fraud); whereas the principal remedy for breach of contract is contractual damages (subject to a remoteness test).

- Second, a seller cannot contractually exclude or limit liability for fraud via exclusion or limitation clauses (and attempts to do so are ineffective as a matter of English law). “Fraud unravels all”, as the saying goes.

Deal teams should note that the approach taken to fraud varies by jurisdiction — some allow for non-reliance clauses to exclude liability for fraud, if drafted with a sufficient degree of explicitness, although case law in many jurisdictions remains fluid and fact-specific.

If fraud is suspected post-closing, buyers should seek legal advice as soon as possible to help them navigate this complex area without causing further harm (see text box).

Best practice for acquirers pre-closing

As deal activity has slowed since the second half of 2022, in many instances acquirers have undertaken more extensive due diligence exercises, including forensic scrutiny of financial information as market valuations have declined, particularly in the technology sector. Recent cases gaining media attention have highlighted the importance of conducting enhanced, comprehensive, and robust due diligence pre-closing, including thorough disclosure exercises which both buyers and sellers should prepare for in advance.

Deal teams should work closely with all of their advisers (internally and externally) and support ongoing discussions between each of them. This collaboration encourages cross-practice information flows, which is critical as issues discovered in due diligence often relate to or overlap across multiple disciplines such as regulatory, employment, tax, and finance.

In providing guidance on the recommended actions to address issues and risks identified, advisers should not only bring in expertise from specialisms such as data privacy and cybersecurity but also litigators to conduct a pre-signing review of key deal items. This includes careful negotiation of acquisition agreement language, including warranties and indemnification provisions and post-closing mechanics. Boilerplate provisions and dispute resolution methods are often more important than is appreciated pre-signing by contracting parties, who are understandably focused on getting the deal over the line.

Post-closing best practice

Acquirers are increasingly conducting a post-closing deep-dive review into the target company, to mitigate against potentially bigger issues and regulatory inquiries. Performing a rigorous risk assessment of internal controls, policies, and procedures, and probing transaction-level data to identify anomalies and risks should now be ordinary course for acquirers. Conducting a cultural review (internally or engaging external advisers to do so) may also be appropriate, particularly if the assessment identifies specific issues. Engaging external lawyers to assist can have the added benefit of ensuring that the product of any review is privileged.

Any reviews should factor in non-data sources, including staff interviews, exit interviews with departing employees, and the creation of whistleblowing hotlines and channels to encourage the flow of information. Acquirers should also take steps to compare financial information pre- and post-closing to identify any significant changes. A thorough compliance programme assessment should also be conducted, considering the target’s approach to anti-bribery and corruption issues, procurement, finance, and compliance.

Considering culture issues post-closing is also important. Buyers should look to use their own robust governance and compliance programmes to enhance and integrate the culture of the target company’s operations and minimise the chances of inheriting major issues. Companies should consider not just a culture assessment post-closing, but also consider their cultural trajectory by designing and implementing a culture framework and strategy. Holistically, such steps can facilitate a more positive culture and reduce the risk of fraud.