The US Securities and Exchange Commission (“SEC”) recently finalized sweeping new rules for private fund advisers (the “PFA Rules”) under the Investment Advisers Act of 1940, as amended (the “Advisers Act”). The PFA Rules reflect the SEC’s stated goal of bringing more transparency to private funds by mandating additional and more granular disclosures. However, they also restrict or impose substantial limitations on certain contractual provisions and industry practices. A coalition of six industry trade groups challenged the PFA Rules in federal court, claiming, among other things, that aspects of the rulemaking exceed the SEC’s authority. We recommend that clients start preparing to implement the PFA Rules despite this case, as the outcome remains unclear.

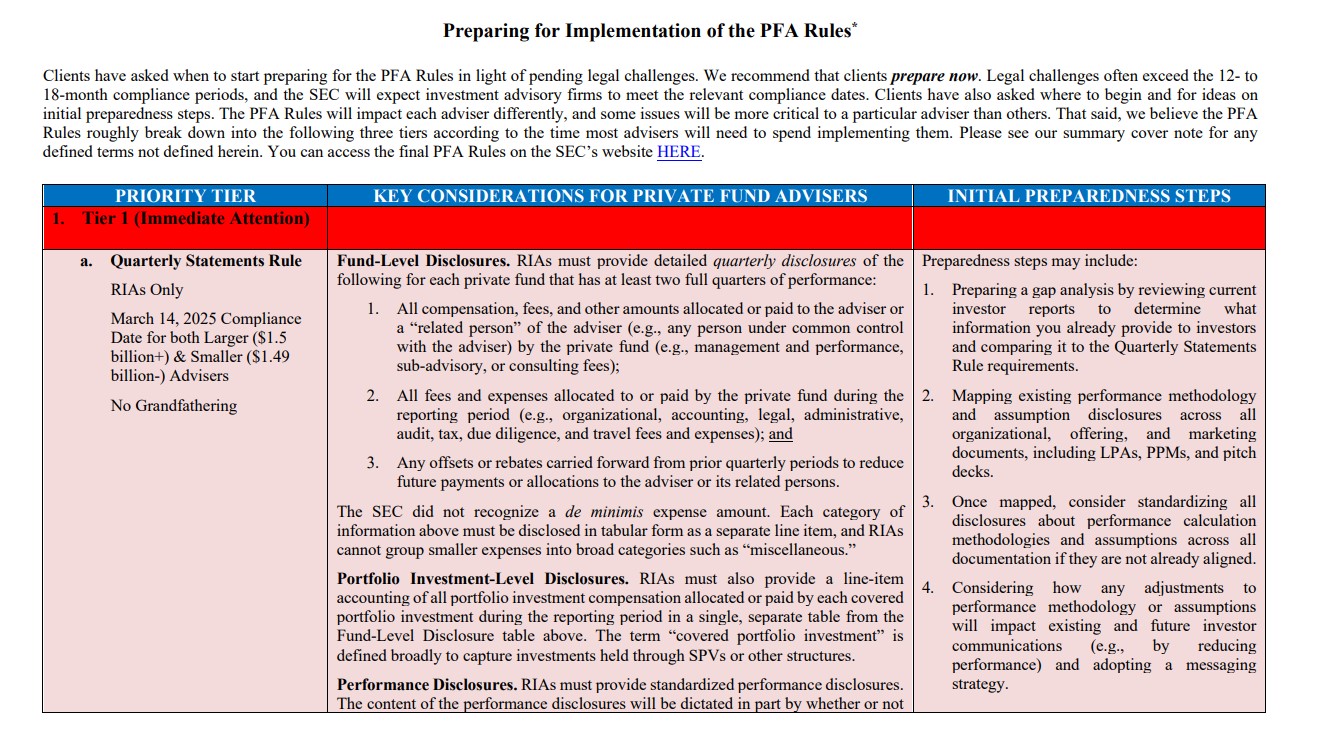

This note and the chart at its end, entitled Preparing for Implementation of the PFA Rules, discuss key components of the PFA Rules, suggest prioritizations for addressing their requirements, and propose initial steps for clients to get started.

Scope and Overview of Key PFA Rule Requirements

The PFA Rules apply primarily to three categories of investment advisers: (i) private fund advisers registered with the SEC (“RIAs”); (ii) advisers that are exempt from most provisions of the Advisers Act but must still meet certain reporting and recordkeeping requirements (i.e., exempt reporting advisers or “ERAs”); and (iii) advisers that are not SEC-registered, including state-registered advisers and advisers who rely on the foreign private adviser exemption who manage US funds. Certain other advisers are either fully exempt (e.g., non-US advisers with respect to their non-US funds even if the funds have US investors) or partially exempt (e.g., advisers to securitized asset funds).

Requirements Applicable Only to RIAs Advising Private Funds

We provide high-level summaries of the PFA Rules below and discuss key aspects of each rule in detail in the chart at the end of this note. The chart also provides the compliance dates for “larger private fund advisers” (i.e., advisers with $1.5 billion or more in private funds assets under management) and “smaller private fund advisers” (i.e., advisers with less than $1.5 billion in private fund assets under management). The following new or amended rules apply solely to RIAs to private funds and not to ERAs or to unregistered advisers. None of the rules immediately below include grandfathering provisions for existing agreements:

- Quarterly Statement Rule – RIAs advising private funds must start distributing quarterly statements to private fund investors. The statements must include extremely detailed fund-level information concerning performance, investment costs, fees and expenses paid by the private fund, and specific compensation and other amounts paid to the adviser. RIAs advising private funds must comply by March 14, 2025, regardless of their size.

- Private Fund Audit Rule – Moving forward, RIAs advising private funds must arrange for an annual financial statement audit for the private funds they advise. This audit must meet the criteria outlined in the existing Custody Rule found in Rule 206(4)-2 under the Advisers Act. Many advisers to private funds already distribute annual audited financial statements to investors. However, this change does eliminate the current option for RIAs to avoid distributing audited financial statements by having an independent public accountant perform a surprise examination of client assets. RIAs advising private funds must comply by March 14, 2025, regardless of their size.

- Adviser-Led Secondaries Rule – RIAs advising private funds must obtain either a fairness opinion or a valuation opinion if they engage in adviser-led secondary transactions by offering existing fund investors the choice of either selling all or any part of their interests in the private fund or converting those interests for stakes in another vehicle advised by the same adviser or its related persons. This rule will also require such RIAs to create and distribute a summary of any significant business relationships they have had with an independent opinion provider within the past two years. RIAs advising private funds must comply by September 14, 2024, or March 14, 2025, depending on the adviser’s size.

- Compliance Rule – The SEC has also amended existing rules to require all registered investment advisers, even those not advising private funds, to document their annual review of compliance policies and procedures in writing. All registered advisers must comply by November 13, 2023, regardless of their size.

Requirements for RIAs, ERAs & Certain Unregistered Advisers to Private Funds

The following new rules apply to a much wider range of advisers to private funds, including RIAs, ERAs, and even certain unregistered advisers (collectively, “covered private fund advisers”). The wide application of these rules means they are substantially more likely to have an impact on the broader private fund industry than the new rules discussed above. Aspects of the Restricted Activities Rule and Preferential Treatment Rule provide for the grandfathering of existing contractual provisions, but only if compliance with the rule would require amending certain fund agreements or credit agreements that existed prior to the relevant compliance date. No grandfathering is available for disclosure provisions in PPMs or any other documents.

- Restricted Activities Rule – Covered private fund advisers must observe new restrictions on: (i) charging or allocating fees or expenses related to an investigation of the adviser by any governmental or regulatory authority without prior investor disclosure and consent; (ii) charging or allocating fees or expenses for investigations or proceedings resulting in sanctions for violating the Advisers Act by any governmental or regulatory authority (such fees and expenses must be repaid if previously charged regardless of any prior investor disclosure or consent); (iii) charging regulatory, examination, or compliance fees without disclosure; and (iv) reducing GP clawbacks of fees from advisers by amounts due for certain taxes without adequate disclosure. Also restricted are non–pro rata fee allocations (e.g., non–pro rata allocations of broken-deal expenses), unless fair and equitable, and borrowing or receiving credit from a private fund client without sufficient disclosure and consent. Covered private fund advisers must comply by September 14, 2024, or March 14, 2025, depending on the adviser’s size.

- Preferential Treatment Rule – At a minimum, covered private fund advisers will have to provide pre- or post-commitment disclosure to investors of any preferential terms offered to other investors. Heightened requirements will exist if preferential redemption rights are offered to any investors and if preferential investment holdings or exposure information is provided to any investors. Covered private fund advisers must comply by September 14, 2024, or March 14, 2025, depending on the adviser’s size.

Please follow the link below to access our chart on Preparing for Implementation of the PFA Rules.

// Click here to view the chart

[View source.]