Welcome to the latest edition of our Quarterly Corporate Update covering recent developments in the British Virgin Islands.

Q4 of 2023 saw a strong uptick in activity in the BVI office. Our corporate legal team continued to advise on key transactions in the jurisdiction while also assisting clients in understanding the many legislative changes to companies law over the previous year.

Transactions

Among the highlights, Partners Anton Goldstein and Rachael Pape, together with Counsel Nicholas Kuria, advised Finaro (formerly Credorax) on its acquisition by U.S. fintech company Shift4 (NYSE: FOUR), a leading provider of integrated payment and technology solutions. Finaro is one of Europe’s primary clearing technology providers in the ecommerce sector and operates as a licensed clearing gateway for Visa and Mastercard, while also providing other financial services such as managing cross-border risks and foreign currency, digital wallets, cryptocurrency and business intelligence. The Conyers team worked alongside Herzog, Fox & Neeman.

Conyers also advised longstanding client Weatherford International Ltd. in connection with the amendment and reinstatement of its LC Credit Agreement dated 17 October 2022, including an increase in the aggregate commitments under the Credit Agreement. Weatherford is one of the world’s largest multinational oilfield service companies which, together with its subsidiaries and affiliates, provides equipment and services used in the drilling, evaluation, completion, production and intervention of oil and natural gas wells. The Conyers team comprised attorneys from our Bermuda office, led by Director Edward Rance, as well as Partner Robert Briant and Counsel Nicholas Kuria of our BVI office, working alongside Latham & Watkins LLP who acted as US counsel to Weatherford.

Partner Rachael Pape and Associate Nina Goodman also advised AdvancedAdvT Limited in connection with the admission of its ordinary shares to trading on the Alternative Investment Market of the London Stock Exchange, with dealings in the shares commencing on AIM on 10 January 2024. The shares were previously admitted to trading on the Main Market of the London Stock Exchange. AdvancedAdvT is an international software solutions provider for the business solutions, healthcare compliance and human capital management sectors.

In addition, Counsel Nicholas Kuria advised Establishment Labs Holdings Inc. (NASDAQ: ESTA), a global medical technology and female aesthetics company, in connection with its private placement of common shares and pre-funded warrants to certain institutional accredited investors. Pursuant to the securities purchase agreement, Establishment Labs agreed to sell two million common shares or, in lieu of common shares, pre-funded warrants at a price of US$25 per share, with the aggregate gross proceeds from the offering expected to be approximately US$50 million.

Publications

Our attorneys continued throughout Q4 to produce thought leadership articles covering a range of pivotal issues and developments impacting offshore entities and the BVI. These include articles discussing the key advantages of BVI companies, steps that BVI real estate holding companies can take to shield themselves from rising financing costs and other pressures, as well as our latest private client and trust bulletin. For the third consecutive year, Counsel Nicholas Kuria contributed the 2023 update on BVI insurance legislation to Thomson Reuters’ annual Regulatory Intelligence Insurance Guide.

In addition to our thought leadership pieces, Partner Rachael Pape and Counsel Nicholas Kuria gave an in-person presentation on Key BVI Company Law Developments, Annual Returns and Economic Substance Updates to BVI-based registered agents and insolvency practitioners in late October, where they outlined several recent changes affecting BVI companies and registered agents, including the new annual return requirements and updates to the economic substance regime.

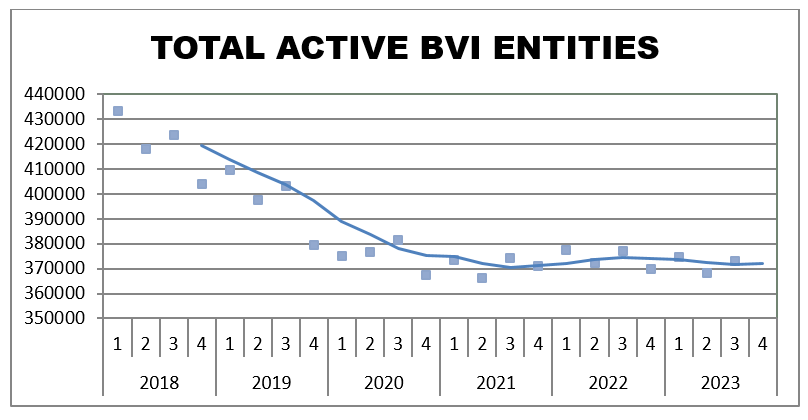

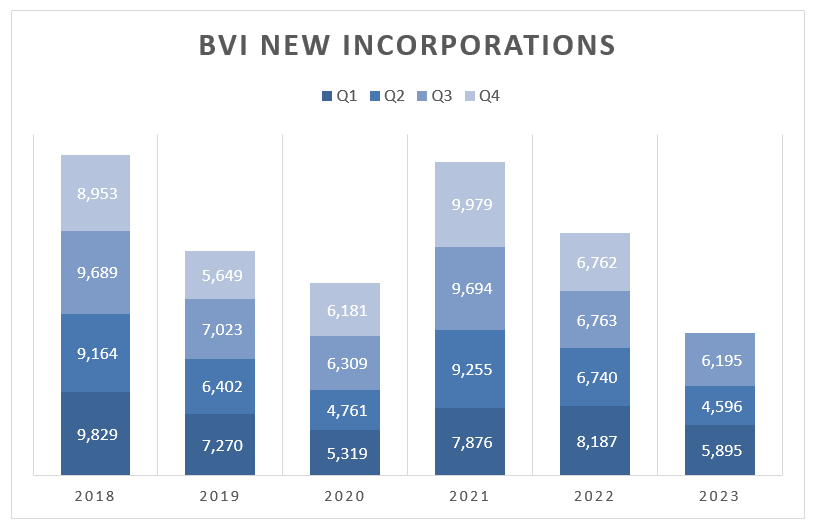

Incorporation Statistics

To help provide an overview of the BVI market, every quarter we provide information on the numbers of new BVI incorporations, total active BVI entities and registered investment funds. We hope they help provide a snapshot of the BVI market.

https://www.bvifsc.vg/sites/default/files/q3_2023_statistical_bulletin.pdf

Source: Statistical Bulletin of BVI FSC.

Source: Statistical Bulletin of BVI FSC.

*Figures for Q3 2023 are as at 30 September 2023

[View source.]