We brought together our experts Susan Young, Dan Hodges, Walt Winter, Justine Ekstrom, and Kathryn Judson to discuss methods to provide meaningful employee benefits while controlling costs.

For many companies, healthcare costs continue to increase for many companies and this trend is expected to continue into 2025, prompting many companies to look for ways to manage expenses and measure the value of their benefits.

To keep costs in check, plan sponsors often turn to two strategies: increasing employee payroll contributions and reducing benefit coverages. Though common, these strategies aren’t always manageable or ideal.

Fortunately, additional employee benefits funding strategies exist that can help save costs while continuing to offer employees valuable and affordable benefits. We brought together some of our experts to discuss methods to provide meaningful employee benefits while controlling costs.

See webinar here

Strategy #1: Measure the ROI of Employee Benefits

For most companies, employee benefits are one of the largest expenses, so it’s important to measure the ROI. Doing so helps determine the value of the benefit programs you offer and find opportunities for adjustments that help reduce costs.

For most companies, employee benefits are one of the largest expenses, so it’s important to measure the ROI. Doing so helps determine the value of the benefit programs you offer and find opportunities for adjustments that help reduce costs.

Companies can measure ROI in three ways:

- Qualitative: Gathering employee feedback to take a qualitative measurement of the impact of benefits. One of the best ways to do so is to survey employees about their overall satisfaction with their benefits package as well as drilling down to specific benefits. Understanding your workforce and their needs is critical, and assessing the value of benefits helps you prioritize your benefits budget.

- Quantitative. To take a quantitative approach, compare retention between employees who are enrolled in benefits and those who aren’t. One company with about 75,000 employees found that the length of service was 3.1 times longer for those employees enrolled in benefits than those who weren’t. While benefits aren’t the sole reason for retention, there is still a strong correlation with benefits enrollment and tenure. Typically, turnover costs far outweigh a company's contribution towards benefits, making this as important calculation.

- Avoiding ACA penalties. Calculate the costs saved by offering benefits to avoid high ACA penalties. There are also tax implications when assessing benefits premiums vs ACA penalties.

Many companies do not have a methodology in place to measure the value of their employee benefits. Gathering this information can provide valuable insights that can influence plan design.

Strategy #2: Self-Funding

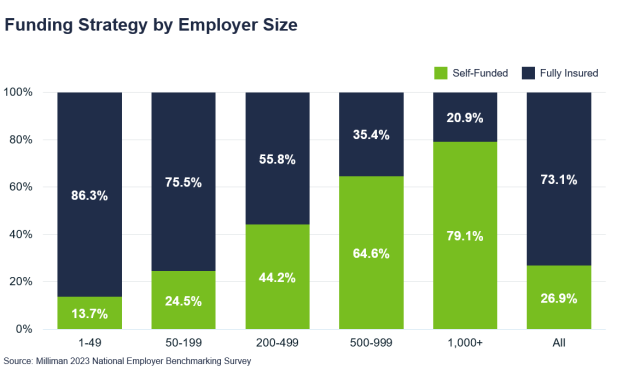

A self-funded or self-insured plan is one in which the employer assumes the financial risk of providing health care benefits to its employees. In practical terms, self-insured employers pay for claims out of pocket as they happen rather than paying a predetermined premium to an insurance carrier for a fully insured plan. Self-funding is a long-term strategy that can save up to 8 to 10% annually.

How does a self-funded plan differ from a fully insured plan?

When you're fully insured, the premium you pay to the insurance company is predictable and easy to budget. The insurance company bears all the risks, but they also retain all the profit when the claims experience is favorable.

When you're self-funded, the insurance company or a third-party administrator bills you for claims plus a small administrative fee. While this adds some additional risk, you still don’t bear the entirety of it. Self-funded plans utilize stop loss insurance for protection for individual large claims and higher-than-expected overall paid claims. Employers purchase a premium for stop loss coverage, but it's a small portion of the overall cost. When the claims experience is favorable, the employer realizes the savings in real time.

There are additional compliance considerations for self-funded plans. For example, the standards for HIPAA compliance are higher for a self-funded plan. Working with a knowledgeable benefit consultant can help you stay on top of compliance requirements.

How does an employer save with a self-funded plan?

The claims experience does not have to be overwhelmingly favorable for an employer to save with a self-funded plan. If claims were exactly the same between a fully insured and a self-funded plan, the self-funded plan will still be less expensive because there is no carrier margin or profit that is included on a fully insured plan. Further, state premium taxes don't apply, and the employer—not the insurance company—gets to hold and manage reserves.

A self-funded plan also yields better claims and utilization data employers can use to customize their plan to include the types of programs that make sense for their population. For instance, if your population is comprised of young, healthy employees with a low prevalence of chronic illness, a program that manages diseases like diabetes and heart disease may not be the best value for your spend.

Will a self-funded plan feel different for employees?

Aside from any vendor or plan design changes you choose to make, a self-funded plan will operate the same for employees as does a fully insured plan. From the employee perspective, claims are submitted and processed the same way. Some employers purposely communicate that their plan is self-funded so they can encourage employees to be good stewards of their health and wise consumers of health care. The “we're all in this together” mentality can contribute to fewer claims and further cost savings.

What types of companies are a good fit for self-funded plans?

Self-funded plans are more prevalent among large employers, but even companies with fewer than 50 employees could benefit from self-funding. Other characteristics of companies fit for self-funding are:

- A focus on a long-term strategy. Sometimes a self-funded plan won’t yield immediate financial savings or savings every year, but employers will save over time.

- Risk tolerance. The employer needs to be willing to accept some risk and ensure they have proper stop loss insurance.

- Adequate cash flow. It’s normal for claim costs to fluctuate from month to month, so the employer needs to be comfortable with variable costs.

- Demographics. Although not required, it's ideal if the group has an average or better than average age and gender makeup.

In some instances, a company may have all these characteristics but still not be suited for a self-funded plan, so it’s important to assess the financial impact. A benefits consultant can perform a self-insured feasibility analysis that projects expected costs under a self-insured plan and compares them to your fully insured cost. If the results are favorable, they can also perform a medical provider network discount analysis to find a network that yields financial savings. From there, your benefits consultant can help you:

- Make an agreement with the insurance company or third-party administrator to administer claims

- Set up stop-loss coverage

- Find a prescription benefits manager (PBM), which can yield additional savings

When companies hit 500 employees, most carriers then consider those companies credible on their claims. What that means is the price paid for premiums is going to be based on the cost of the claims incurred. At this stage, fully insured versus self-funded plans are priced at a very similar rate, so it makes sense to consider self-funding to save on things like carrier profit margins and taxes.

Captives in stop loss are also an option to explore, especially for mid-size to smaller employers. The captive takes on risk and creates more advantages with different terms and conditions to help stabilize the renewal, which can be more volatile for smaller companies.

Walking through these steps with a knowledgeable benefits consultant can help ensure you’re making the most cost-effective choices for your self-funded plan.

Walking through these steps with a knowledgeable benefits consultant can help ensure you’re making the most cost-effective choices for your self-funded plan.

Strategy #3: Population Health Management

Population Health refers to the health outcomes of a group of individuals (like an employer group).

What is Population Health Management ?

Population Health Management (PHM) is the process of going beyond wellness to improve clinical health outcomes for members supported by comprehensive data analytics. This data tracks employee health needs at all points along the continuum of care, through participation, engagement, and targeted interventions to maintain or improve the physical and psychosocial well-being, while aiming to reduce cost growth. Data provides insights to manage, interpret, and act on claims information to improve health outcomes through areas like:

- Preventing and Treating Disease: chronic gaps in care, comorbid members, forecasting of event predictions, high-risk members and if preventive care is being utilized effectively

- Increasing Care Efficiency: avoidable inpatient admissions, avoidable ER, and ER pattern of use

With cost saving opportunities in focus, your benefits consultant can better assess point solutions or carrier programs to close compliance gaps, create incentives to assure members receive the necessary checkups for chronic conditions, and track the impact on a company’s population.

Using population health management to guide plan design changes

Population health management also allows companies to associate health outcomes with plan design changes.

Employing a cancer screenings and detection program is a prime example.

- Early onset cancer (people <50) cases have increased 79% in the past 20 years

- Oncology treatments are four times as costly as therapies for other conditions

- Cancer drug launch prices increased 53% in just the last five years

These statistics demonstrate that cancer is both more prevalent and costly than ever before. That means paying for the program costs of promoting cancer screenings and advance cancer detection programs could save hundreds of thousands of dollars, if not millions, down the line.

Another example is mental health. The majority, up to 93%, of members with a mental health condition also have at least one chronic condition. This makes mental health the most common underlying disease factor and covering mental healthcare costs could save significant money on paying claims for chronic conditions.

Similarly, obesity can lead to diabetes, heart disease, gastrointestinal disorders, musculoskeletal disorders, and cancer. Paying for prescription drugs to treat obesity as a chronic condition could stem claims for more costly conditions down the road.

What types of companies should leverage a population health management strategy?

Because self-insured companies pay for their own claims and receive data specific to their population, they will likely see the largest impacts of a population health management strategy. However, fully insured companies can still see benefits from putting these programs in place, especially in terms of better employee health.

Strategy #4: Transparency in Healthcare Costs

Being transparent with employees about your healthcare costs can also help reduce costs.

If employees can easily understand cost and quality options, they are much more likely to. You wouldn’t buy large luxury items like jewelry, cars, and homes without knowing the price, and healthcare shouldn’t be any different.

Educate employees about price variances

It’s important for companies to educate employees about price variances for procedures. Most people realize that they will pay less by going to an in-network doctor or an in-network facility rather than going to an out-of-network provider, which is usually the case. What many people don’t realize is that not all in-network providers will charge the same price. A simple checkup may cost hundreds of dollars more at one in-network provider compared to another.

If employees are educated about costs and learn to shop for the best price for care, it can save both them and the employer significant money. When employers spend less on healthcare, they have more money to invest in other things that can benefit employees, like raises, bonuses, and technology.

Higher prices don’t necessarily mean higher quality

Unlike most things we buy in everyday life, higher healthcare prices don't necessarily mean higher quality.

For instance, a surgery performed at a hospital might cost $35,000 but only $12,000 at a free-standing specialty clinic for the same procedure. Even though this is a large difference in pricing, the freestanding facility may perform the surgery far more often than the hospital, making them more experienced and more likely to offer better care. This is one example of how a lower-cost healthcare option can offer higher quality.

Two types of health literacy

According to the , two types of health literacy exist: personal health literacy and organizational health literacy. Both are an important part of a transparent cost strategy.

- Personal health literacy is the degree to which employees can find, understand, and use information to inform health-related decisions and actions for themselves and others.

- Organizational health literacy is the extent to which organizations empower individuals to find, understand, and use information and services to inform their health-related decisions and actions.

While it is up to the employee to shop for high-quality, low-cost options, the employer must also provide the education and tools that empower them to do so.

According to the Partnership for Clear Health Communication at the National Safety Patient Foundation, compared to those with proficient health literacy, adults with low health literacy experience:

- 4 times higher health care costs

- 6% more hospital visits

- 2-day longer hospital stays

All of these lead to more claims and higher expenses.

Healthcare navigation solutions

A healthcare navigation solution can help employees find the information they need to make informed choices.

Employees might not need help comparing prescription drug costs at different pharmacies, but calling around to hospitals to understand pricing is a lot more difficult. Some hospitals may not even know the price of a service because billing is handled by a third party. A healthcare navigation vendor can help with this.

How to find a healthcare navigation solution

Your healthcare provider or third-party administrator may be able to help you find a healthcare navigation vendor. At a minimum, an effective solution should:

- Be easy to understand and intuitive to use

- Include quality ratings

- Provide pharmacy cost comparisons

- Come with a communication and incentive strategy that helps employees understand how and why they should use it

When selecting a healthcare navigation vendor, it’s also important to understand how your population prefers to consume the information and make sure the vendor can provide it in that manner. For instance, some individuals may prefer an app on their phone, while others value articles and research. Field employees may not have easy access to online resources, while busy professionals need a concierge service. Providing the information in a way that is easy for employees to access and meets their preferences is key to making a healthcare navigation solution work for your company.

Work with Your Benefits Consultant

Employers should adopt a strategic approach to managing employee benefits costs, considering both short-term savings and long-term sustainability. A proactive and adaptive approach to benefit management mitigates financial strain and fosters a healthier and more engaged workforce. Working closely with your benefits consultant and frequently comparing costs to the budget will help determine if it’s time for you to consider revising your plan design.

To learn more about employee benefit funding strategies, reach out to your Woodruff Sawyer representative.

Our Mission to More series offers guidance from leading specialists on what employees want and how employers can adapt to the new benefits universe. For more guidance on the latest in employee benefits, sign up for Woodruff Sawyer’s Benefits newsletter, which includes all Mission to More articles