Editor’s Note: The number of healthcare transactions reached a record-smashing 1,738 in 2018.1 According to a new Capital One poll, mergers and acquisitions are the preferred growth vehicle for 44% of healthcare executives in 2019, indicating that we will continue to see M&A on the rise. What are the trends driving the growth in healthcare transactions? What are the new M&A strategies remapping the healthcare landscape? In a recent webinar, Manatt Health shared the answers. In part 1 of our article summarizing the webinar, below, we examine the major healthcare trends fueling the changes in healthcare M&A. Watch for part 2 in the May issue of “Health Update,” featuring a deep-dive look at provider transactions and part 3 in June, sharing an in-depth analysis of health plan transactions. Click here to view the full webinar free, on demand—and here to download a free copy of the presentation.

__________________________________________

In the last year, we have seen a steady growth in healthcare M&A transactions. The high rate of deals we saw throughout 2018 carried over into the first quarter of this year, with the number of deals exceeding $20 million increasing every quarter and approaching 500 in Q1 2019. (See figure 1.)

Figure 1:

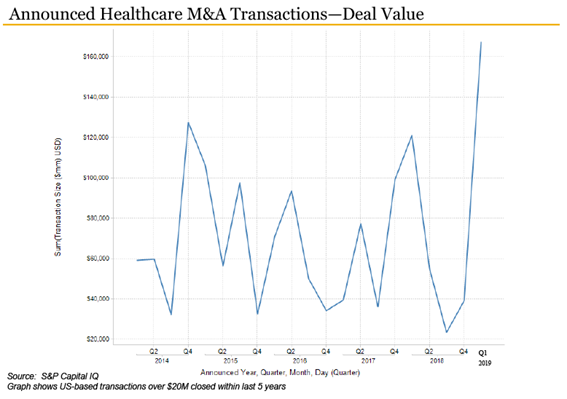

In contrast, deal value took a dip in 2018, particularly in the last two quarters of the year. Deal value peaked in March of 2018, when Cigna announced its acquisition of Express Scripts, but then took a precipitous plunge. It has bounced back in the first quarter of 2019, with the rise fueled by large deals announced and closed in the long-term care and pharmaceutical sectors. (See figure 2.)

In contrast, deal value took a dip in 2018, particularly in the last two quarters of the year. Deal value peaked in March of 2018, when Cigna announced its acquisition of Express Scripts, but then took a precipitous plunge. It has bounced back in the first quarter of 2019, with the rise fueled by large deals announced and closed in the long-term care and pharmaceutical sectors. (See figure 2.)

Figure 2:

Healthcare M&A Transactions by Sector

Bloomberg Law data comparing 2017 and 2018 transactions shows significant increases in several key areas. The number of hospital and health system deals increased from 91 in 2017 to 172 in 2018, showing a substantial jump. Physician practice and service deals (147 to 181), behavioral health deals (49 to 62) and rehab deals (24 to 40) also show strong growth from 2017 to 2018.

In addition, digital health M&A volume is showing high growth, more than tripling in the last five years, from 17 in 2013 to 54 in 2018—the highest volume of digital deals ever completed in one year.2 The increase in deals is driven by a maturing market for large pharmaceutical companies and tech giants that are seeking to expand by getting a foothold in digital health through buying startup solutions.

The big digital deal everyone was talking about last year was Amazon’s purchase of Pill Pack for $1 billion. Pill Pack is a mail order company with drug distribution and pharmacy licenses in multiple states—and it recently applied for licenses in a string of additional states. It gives Amazon a way to fill prescription orders quickly. On its web site, Pill Pack says that its mission is to become the earth’s most customer-centric pharmacy.

Best Buy also reached into the healthcare space last year with its $800 million purchase of Great Call. Focusing on the growing over-65 population seeking to lead independent lives, Great Call provides connected health and emergency response services for seniors who can push a button if they’ve fallen or need help.

Recent Major Hospital Deals

In the last year, according to Bloomberg Law, there were 172 hospital/health system transactions. Two large for-profit deals top the list—Hospital Corporation of America’s (HCA’s) acquisition of Mission Health for $1.5 billion that closed in January 2019, and RCCH Healthcare Partners’ purchase of Life Point Health for $5.6 billion that closed in November 2018.

Last year also saw a number of major nonprofit mergers. Notably, many of these mergers went beyond the parties’ home markets and crossed state lines. For example, Advocate Health Care and Aurora Health Care combined to create a 27-hospital system with $11 billion in revenue, and Bon Secours Health System joined with Mercy Health in September 2018 to form a 43-hospital system with $8 billion in revenues. Atrium Health and Navicent Health joined together in January 2019—and that same month, Dignity Health merged with Catholic Health Initiatives (CHI) to form Common Spirit, a system that now has 142 hospitals and $29 billion in revenue.

Recent Major Health Plan Deals

We’ve also seen a significant number of health plan deals closing over the last year. In September 2018, WellCare closed its deal to acquire Meridian for $2.5 billion. Everyone is now curious to see what will happen after Centene’s announcement in March 2019 of its planned $17.3 billion acquisition of WellCare. Both entities focus on government plans, making this a very interesting deal to watch.

In March, we also saw the announcement that Cambia and Blue Cross Blue Shield of North Carolina, the two major Blue insurers, also are combining resources in a strategic alliance. Though this is not a merger or acquisition, the two insurers plan to share management, administrative, operational and other corporate services under the Cambia Health Solutions name.

The Continued Rise of Vertical Integration

The big headline in M&A news for 2018 was the increasing vertical integration in the health plan space. Companies are merging with others up and down the supply chain, including pharmacy benefit managers (PBMs), pharmacies and providers. The vertical activity has caught the attention of the Federal Trade Commission (FTC), with the two Democrats on the five-member commission (Rebecca Kelly Slaughter and Rohit Chopra) pressing for increased scrutiny of vertical mergers. Though the Democrats are the minority, their concerns could mean longer and more costly investigations, even for deals that the FTC ultimately clears.

The major vertical integration deals over the last year include:

-

The United Health Group/OptumRx acquisition of Genoa Healthcare for $2.5 billion that closed in September 2018

-

The Cigna acquisition of Express Scripts for $67 billion that closed in December 2018

-

The Humana acquisition of Kindred for $4.1 billion that closed in July 2018

-

The CVS Health acquisition of Aetna for $69 billion that closed in November 2018

-

The United Health Group/OptumRx acquisition of Davita Medical Group for $4.43 billion that is still pending

The Healthcare Industry Drivers Impacting Healthcare M&A in 2019

One of the biggest trends impacting healthcare M&A in 2019 is the focus on redesigning care around consumers. Consumer-centric care stresses providing affordable care with transparent pricing. It also includes using data more effectively to improve quality and outcomes, such as through personalized medicine or interoperable data exchange.

Other major trends include:

-

The increase in care that integrates physical and behavioral treatment, as well as social services addressing issues such as transportation, housing and food security.

-

The growing centrality of states through Medicaid expansion and waivers to drive coverage and innovation; the increased use of managed care to reduce costs, improve access and enhance quality; and the rise in the number of states (such as New Jersey) setting up their own health insurance exchanges.

-

The focus on reducing regulatory burdens, with the “regulatory sprint to coordinated care” involving potential significant changes to several major healthcare laws, including the Stark Law, the Anti-Kickback Statute, the Health Insurance Portability and Accountability Act (HIPAA) and 42 CFR Part 2 (which protects the privacy of substance use disorder patients by prohibiting unauthorized disclosures of patient information except under very limited circumstances). Centers for Medicare & Medicaid Services (CMS) Administrator Seema Verma also has the “Patients over Paperwork” initiative to reduce regulatory burdens so providers can focus on care delivery instead of filling out forms.

Note: Watch for part 2 of our summary focusing on provider transactions in the May “Health Update” and part 3 analyzing plan transactions in June.

1. S&P Capital IQ.

2. MobiHealthNews.