Rising interest rates and geopolitical uncertainty put the brakes on new IPO activity across global markets in 2023. However, after a challenging period, the outlook for IPO activity in 2024 is improving

Where we've been

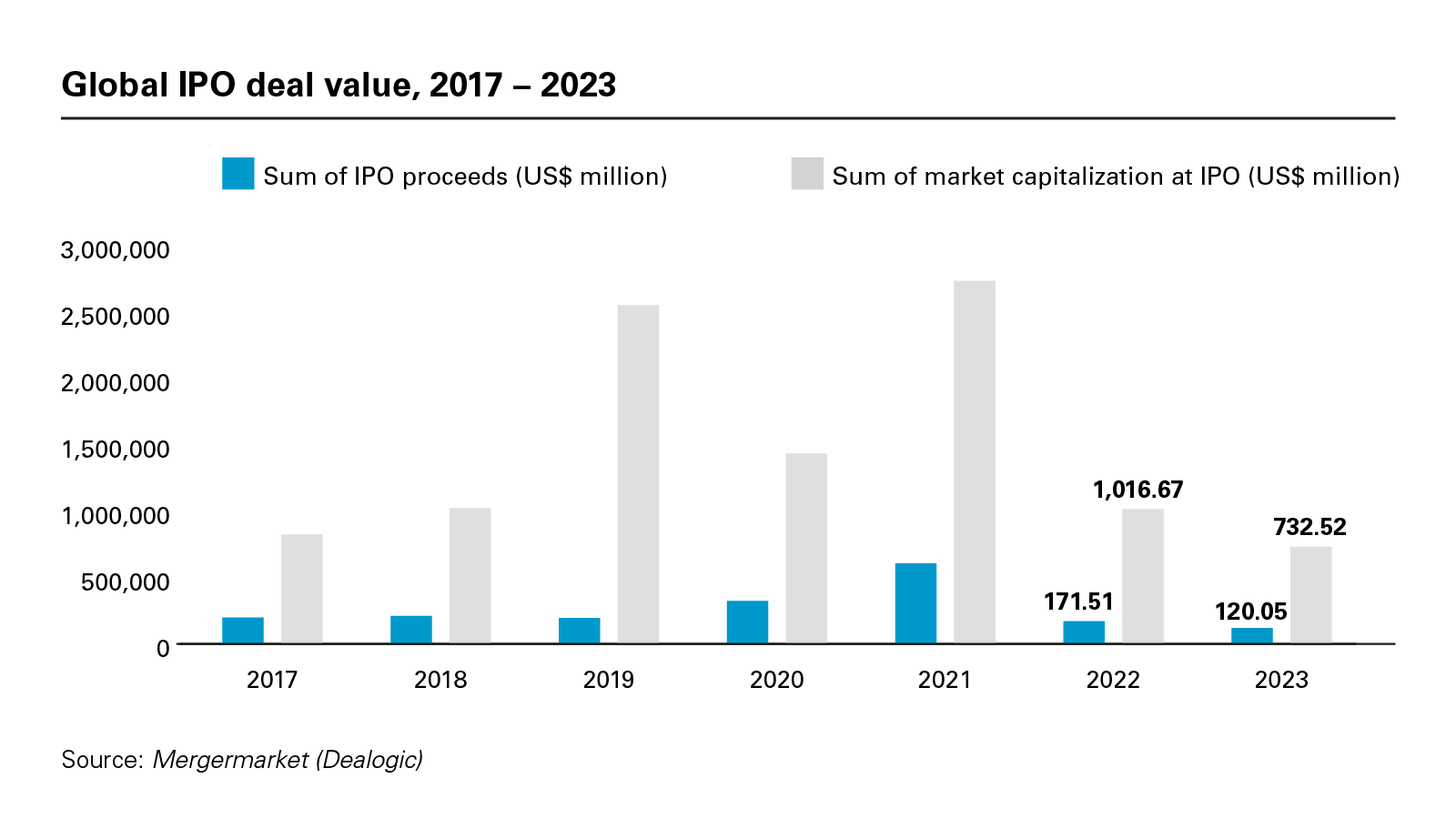

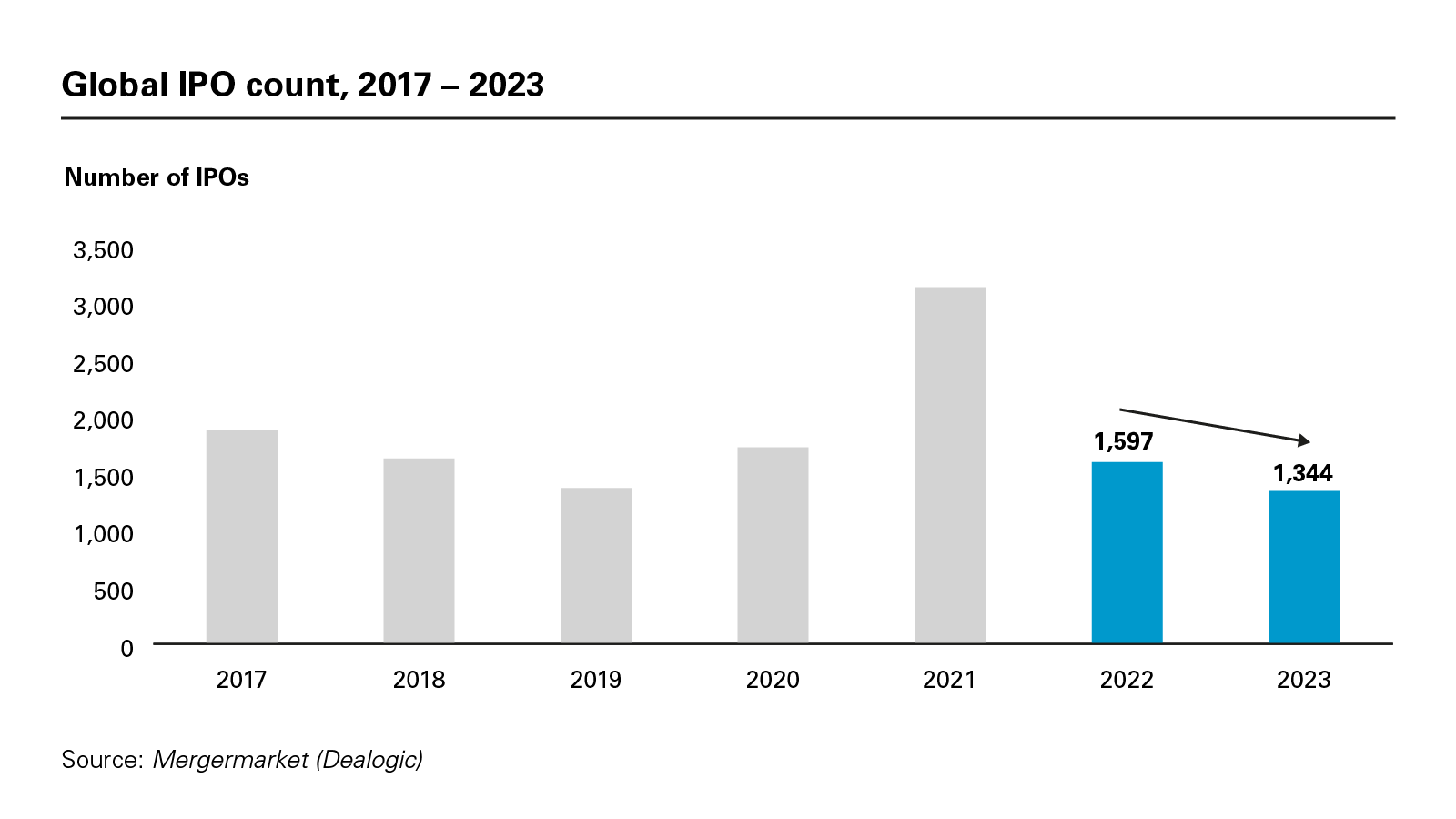

Global IPO deal value and deal count fell to six-year lows in 2023, reflecting a challenging year for the broader capital markets.

Proceeds from IPOs globally fell 30 percent year-on-year to US$120.05 billion in 2023, while the number of IPOs globally dropped 16 percent to 1,344 IPOs, as inflation and interest rate hikes in key markets weighed heavily on offering activity. Stock markets across all jurisdictions felt the macroeconomic headwinds as central bankers in the US, UK and Europe increased interest rates multiple times during the past two years as part of a prolonged attempt to combat rising inflation.

View full image: Global IPO deal value, 2017 – 2023 (PDF)

View full image: Global IPO deal value, 2017 – 2023 (PDF)

Inflationary and interest rate pressures also weighed on Latin American markets, with no IPOs recorded in Brazil, the region's largest economy, for two years. Moreover, in Asia-Pacific, disruption in China's real estate sector had an adverse effect on the broader economy and negatively impacted IPO activity.

IPO sentiment across all regions was also adversely affected by rising geopolitical tensions and the conflicts in Ukraine and the Middle East. Furthermore, upcoming elections in the US, Mexico, UK and India have added layers of uncertainty for investors to navigate.

View full image: Global IPO count, 2017 – 2023 (PDF)

View full image: Global IPO count, 2017 – 2023 (PDF)

View full image: Top 10 IPOs, globally, by deal value, in 2023 (PDF)

View full image: Top 10 IPOs, globally, by deal value, in 2023 (PDF)

Where we're going

Notwithstanding the diverse obstacles that hindered IPO activity in 2023, there is reason for cautious optimism for deal activity in 2024, as interest rates stabilize and stock markets rally.

Encouragingly, global stock market valuations have rebounded in recent months, with the MSCI All Countries World Index showing gains of more than 7 percent during the first quarter of 2024, and more than 20 percent during the past 12 months. These higher valuations will make IPOs more attractive to issuers and selling shareholders, especially those who may have put IPO plans on hold in 2022 and 2023 when valuations and outlooks dropped.

In particular, new IPO issuance will be driven by the growing pressure on private equity managers to realize exits and make distributions to investors after a slow year in 2023. According to Mergermarket, global private equity exit value slid 45 percent year-on-year to US$337.34 billion in 2023, the lowest level observed in a decade.

This has led to a backlog of unsold portfolio companies. According to Bain & Co., buyout funds have US$2.8 trillion worth of unsold companies on their books—more than four times the levels observed during the 2008 financial crisis. Private equity managers will only be able to sit out for so long, and, as the demand to exit intensifies, IPOs will return as a key solution for selling portfolio companies.

US to lead recovery

The US—home to the New York Stock Exchange and Nasdaq (the world's two largest stock exchanges)—is well positioned to lead a global IPO rebound.

Notwithstanding inflationary and interest rate factors, the US economy has proven resilient throughout the downcycle, growing by 2.5 percent year-on-year in 2023. This helped to support a marginal year-on-year increase in US IPO proceeds to US$23.9 billion in 2023, although the past two years of IPO issuance have come in materially below the US$316.63 billion of IPO issuance secured in the US at the peak of the market in 2021.

Nobody is anticipating a return to the heights of 2021. However, US IPO activity is already improving in 2024, with the number of US IPOs during the first two months of 2024 up 24 percent compared to the same period last year, as well as the landmark IPO of social media company Reddit on the New York Stock Exchange in March, pricing at the top end of its range and showing strong initial trading.

Further, more visibility on inflation and interest rates will also help increase IPO activity in Europe, and the strong post-IPO performance of German defense contractor Renk and Greece's Athens International Airport following their market debuts in early 2024 have set the tone for a potentially more active European IPO market for the rest of the year. Swedish IPO markets are expected to be among the climbers in Europe, as more private equity firms (a particularly key source of IPO candidates in Sweden) line up assets for exit, while the London Stock Exchange should benefit from reforms set to make the UK listings regime more competitive.

In Asia-Pacific, the Hong Kong Stock Exchange is also set to have a better year, benefiting from the introduction of a series of strategic listings reforms and growing interest from issuers in the Middle East.

After performing well in 2023, India's market is expected to have another good year in 2024. India was one of the few jurisdictions where the number of IPOs (234) bucked the global downward trend, as robust domestic economic growth saw India deliver the highest number of IPOs in the world in 2023.

In Latin America, optimism is also growing, with all eyes on the region's largest economy, Brazil. After a two-year hiatus, Brazil's IPO markets are preparing to spring back to life, as a number of businesses in the financial services, utilities and mining sectors prepare for listings. Investors are also closely watching the developments in Argentina, where the election of President Javier Milei, who ran on a platform of pro-market economic reform, has seen Argentine stock markets climb by more than 350 percent over the past 12 months to the end of Q1 2024. Mexico will be another Latin American jurisdiction to watch, with the IPO of discount retailer BBB Foods (which operates the Tiendas 3B store network) early in 2024 opening the way for other IPO candidates.

Overall, after a choppy 2023 for almost all jurisdictions, global IPO markets appear to be moving in the right direction.

[View source.]