As a reminder, each registered investment adviser must file an annual updating amendment to its Form ADV within 90 days of its fiscal year end. This means an adviser with a December 31 fiscal year end will be required to file an annual updating amendment to its Form ADV by March 31, 2025. We are here to help with the legal needs affecting your advisory business, including:

- Preparing and filing the annual updating amendment

- Navigating recent and upcoming regulatory changes

- Assisting with ongoing compliance requirements throughout the year

Preparing for the annual updating amendment

In the annual updating amendment, advisers must update their responses to all items in Part 1A, 1B, 2A and 2B (as applicable), including the corresponding sections of all schedules. Advisers may, but are not required to, submit amended versions of the relationship summary required by Part 3, as part of the annual updating amendment.

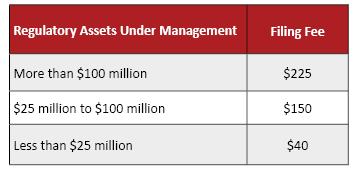

SEC-registered investment advisers must pay the fee reflected in the table below based on the amount of their regulatory assets under management. Filing fees are waived for state-registered firms.

Fees must be deposited to the firm's IARD Flex-Funding Account before the annual updating amendments may be submitted. Each firm should review their Flex-Funding Account now to determine whether it must make any deposits to their accounts—this is not something to save for the last minute as account transfers can take days. Firms may submit payments by check, wire transfer, or electronic payment/transfer. Instructions and relevant addresses are available at the following links:

Within 120 days of its fiscal year end, an adviser must deliver to each client (1) a free updated brochure that either includes a summary of material changes or is accompanied by a summary of material changes, or (ii) a summary of material changes that includes an offer to provide a copy of the updated brochure and information on how a client may obtain the brochure. This means an adviser with a December 31 fiscal year end will be required to deliver its brochure to clients by April 30, 2025.

Navigating recent and upcoming regulatory changes

Numerous regulatory changes will or may soon affect investment advisory businesses, including:

- Additional Amendments to Form PF, updating the information reported by private fund advisers (final SEC rule).

- Amendments to Regulation S-P, adding new requirements that include, among others, adopting incident response programs, providing client notifications about data breaches, and new recordkeeping requirements (final SEC rule).

- Anti-Money Laundering and Countering the Financing of Terrorism Requirements for Investment Advisers and Exempt Reporting Advisers, requiring SEC-registered advisers and ERAs to implement an AML/CFT program, file SARs and reports with respect to currency transactions, and comply with recordkeeping requirements (final FinCEN rule).

- Customer Identification Program Requirements for Registered Investment Advisers and Exempt Reporting Advisers, proposing to require SEC-registered advisers and ERAs to establish, document, and maintain written customer identification programs (CIPs) appropriate for their respective sizes and businesses (proposed SEC rule).

- Short Sale Disclosure, requiring institutional investment managers that meet or exceed certain reporting thresholds to report on Form SHO certain short position and short activity data for equity securities (final SEC rule, compliance date of January 2, 2025).

Compliance with these new requirements may require significant updates to firms’ existing policies and procedures and overall compliance programs.

Assisting with ongoing compliance requirements throughout the year

While it remains to be seen how a change of administration will affect the SEC’s priorities going forward, to date the SEC has continued to press firms generally regarding business continuity and cybersecurity matters, marketing practices and compliance with the Marketing Rule, impermissible hedge clauses in advisory agreements and recordkeeping with respect to off-channel communications. The SEC also recently settled a series of enforcement actions to address violations of the whistleblower protection rule, which prohibits market participants from taking any action to impede would-be whistleblowers from contacting the SEC. Although the number of enforcement actions brought by the SEC dropped in 2024 compared to the prior year, these actions resulted in a record $8.2 billion in financial remedies. While some of these actions involve willful fraud, many are for compliance oversights. Taking a proactive approach to compliance can help firms avoid becoming another enforcement statistic.