What happened

New SEC disclosure requirements take effect soon. Together with recent accounting guidance, it’s timely for companies to review their equity grant practices and any vulnerabilities to criticism for “spring-loading” or “bullet-dodging” in their awards to senior management.

- As discussed in our December 15, 2022 post, companies must provide a detailed table for grants of options, SARs and similar instruments to NEOs made within four days before or one day after the release of material non-public information. They must also describe grant policies and practices for such instruments, including how they account for release of material non-public information in the timing of making such grants. These requirements apply to proxy statements filed later this year, in the case of September 30 companies, or in 2025, in the case of calendar year companies. Compliance is delayed by six months for smaller reporting companies.

- As discussed in our December 3, 2021 post, the SEC staff issued SAB No. 120 to provide guidance on fair value accounting for spring-loaded equity awards that companies should consider.

Takeaways

In view of the new requirements, companies should:

- Consider whether to adopt or revise policies relating to timing of such grants in relation to material announcements.

- Regularize and limit the number of grant dates (even for new hires), ideally during quarterly window periods following the filing of 10-Ks or 10-Qs, when the company is no longer aware of any other material non-public information. Tabular disclosure can be avoided for grants outside the specified window.

- Consider adjusting the timing of Committee action in respect of such grants or whether to determine the exercise price based on the market price after the filing of such reports.

- Establish requirements for off-cycle awards, such as for new hires or promotion or retention, to require pre-clearance to confirm no anticipated disclosure of material non-public information.

- In all cases, avoid such grants to NEOs within four days before or one day after filings of 10-Ks, 10-Qs or 8-Ks containing material non-public information.

- Evaluate their controls and procedures related to equity award practices.

- Coordinate with accounting staff on documentation requirements in light of the SAB No. 120.

- Seek guidance from auditors as to any concerns for grants made outside window periods.

- Consider new SEC disclosure requirements, including:

- Tabular disclosure of details for such grants made to NEOs within four days before or one day after the release of material non-public information, including in 10-Ks, 10-Qs and 8-Ks.

- Narrative disclosure about grant policies and practices for options and option-like instruments (such as SARs and similar instruments) regarding the timing of grants and the release of material nonpublic information.

- Consider existing SEC disclosure requirements, including:

- The fair value of each equity award, in a column of the stock-based award table next to the base price (or, if lower, the closing market price).

- The date the board or committee met to grant the award, if different from the grant date.

- The “methodology used to determine the exercise price if . .. [it] is not the closing price per share on the grant date.”

- The need to timely file Form 4 reports for such grants.

New SEC disclosures

As discussed in our December 15, 2022 post, proxy and information statements must disclose company grant policies and practices for options, SARs and similar instruments, using Inline XBLR. The new disclosures are designed to shine light on -- and thereby discourage -- disfavored grant practices such as “spring-loading” or “bullet dodging,” in which executives can benefit from an immediate stock price increase or avoid an expected decrease following the release of material news.

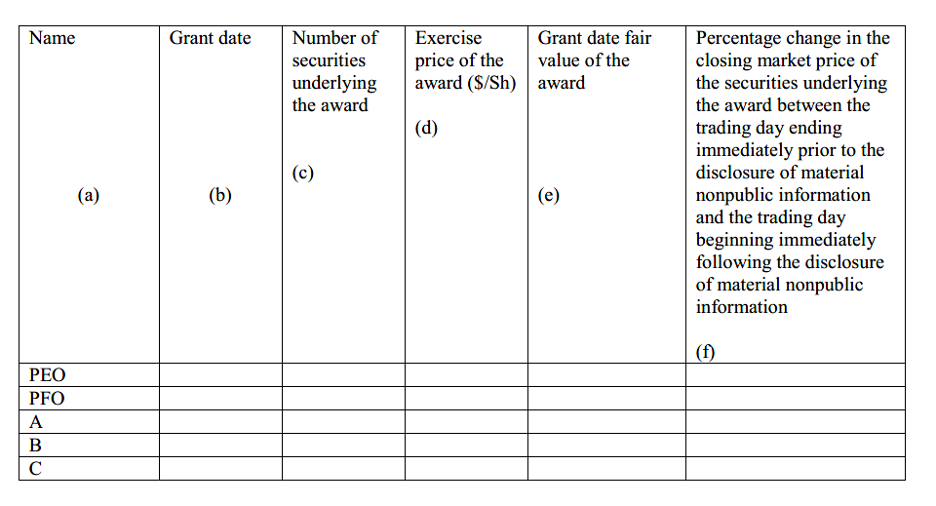

- New Table. If, during the last fiscal year, a company made grants to NEOs within four days before or one day after the release of material non-public information – such as the filing of a periodic report or the filing or furnishing of a current report on Form 8-K that contains material nonpublic information -- the company must disclose specified details about those grants in the following table, including the percentage change in the market value of the securities underlying the award between those dates:

- Narrative disclosures. The new rules require narrative disclosure about the company’s grant policies and practices for options and option-like instruments (such as SARs and similar instruments) regarding the timing of grants and the release of material nonpublic information, including how the board determines when to grant options and whether, and if so, how, the board or compensation committee takes material nonpublic information into account when determining the timing and terms of an award. Note that, although good practice, the disclosure requirement does not itself formally require a company to adopt policies or practices on the timing of such awards.

SEC accounting guidance

The new disclosures reinforce the SEC’s recent attention placed on equity grant practices. As discussed in our December 3, 2021 post, the SEC staff addressed fair value accounting for spring-loaded equity awards in Staff Accounting Bulletin No. 120 (Nov. 2021), instructing companies to consider the expected increase in stock prices or expected price volatility in light of material non-public information – particularly with non-routine awards.

The guidance states:

- Although companies typically have non-public information when making awards, the staff believes that grant date stock prices are “generally a reasonable and supportable estimate of the current price of the underlying share in a share-based payment transaction, for example, when estimating the grant-date fair value of a routine annual grant to employees that is not designed to be spring-loaded.”

- “However, companies should carefully consider whether an adjustment to the observable market price is required, for example, when share-based payments arrangements are entered into in contemplation of or shortly before a planned release of material non-public information, and such information is expected to result in a material increase in share price. The staff believes that non-routine spring-loaded grants merit particular scrutiny by those charged with compensation and financial reporting governance.”

- “Additionally, when a company has a planned release of material non-public information within a short period of time after the measurement date of a share-based payment,” the staff believes a material stock price increase upon the release of such information “indicates marketplace participants would have considered an adjustment to the observable market price on the measurement date to determine the current price of the underlying share.”

[View source.]