The number of merger notifications in 2023 mirrored that of 2022 but remained significantly below the numbers seen in the past. It remains to be seen whether the number of notifications will further decline in the coming years or whether a potential uptick in M&A activity will lead to higher numbers. The 11th amendment to the GWB that came into effect on 7 November 2023 may have an impact on the number of filings. This amendment equips the FCO with an additional intervention tool to address “significant and ongoing disruptions to competition” identified in sector investigations. Mergers that fall below the statutory notification thresholds can be subject to notification requirements if the FCO has indications from a sector investigation that further mergers would significantly impede competition in the relevant industry.

In 2024, the FCO could potentially apply its new intervention power in two sectors – the online advertising sector and the municipal waste collection and hollow glass processing sector – where it has already released the conclusive reports of the inquiries (on 15 May 20231 and 28 December 2023, respectively).2 Additionally, sector inquiries are currently ongoing in the electronic vehicles charging infrastructure3 and the refineries and wholesale fuel trade4 sectors.

Just one day before the 11th amendment to the GWB came into effect, the Federal Ministry for Economic Affairs and Climate Action (“BMWK”) initiated a public consultation in respect of a potential 12th amendment.5 This consultation, held from November to December 2023, engaged a broad spectrum of stakeholders, including industry associations, legal professionals, and academics, who contributed their perspectives. In relation to merger control, the discussion centred around a potential further increase in turnover thresholds and the possible need for further adjustments to the transaction value threshold to provide legal certainty for merging parties. The BMWK is set to evaluate these responses in early 2024, with the 12th GWB amendment expected to come into effect in early 2025.

Based on formal decision only, 2023 seems like a good year for merging parties, with only four cases leading to remedies in Phase I and one unconditional clearance in Phase II. After three years of strict enforcement leading to one ban per year, including the TF1/M6 deal that was abandoned by the parties in 2022 after the FCA announced it would be blocked, the FCA did not prohibit any transaction in 2023.

However, a closer examination reveals a different picture. First, while the number of clearances in Phase I with remedies has declined, the number of Phase II investigations has risen. That trend is similar to the one observed at the European Commission’s level, as agencies are becoming increasingly reluctant to clear potentially problematic deals within the time constraint of a Phase I review, irrespective of the remedies offered by the parties. Second, a thorough analysis of the transactions subjected to an in-depth Phase II review shows that the FCA’s scrutiny has not slackened.

The exclusive takeover of Smartbox by Wonderbox, both active in the gift voucher market, notified in March 2023, was ultimately abandoned by the parties before the end of the year. The same applies to the proposed joint venture between Euralis and Maïsadour in the foie gras production sector, abandoned in August 2023.7 Taking these deals into account, the enforcement trend over the past three years shows stricter enforcement by the FCA, with fewer remedies accepted in Phase I and no remedies accepted in Phase II since 2020. Of note, this trend of fewer settlements and more withdrawals matches data presented for the United States in the U.S./EU DAMITT 2023 Annual Report, but suggests that the FCA still remains more open to considering settlements that their U.S. counterparts – at least in Phase I.

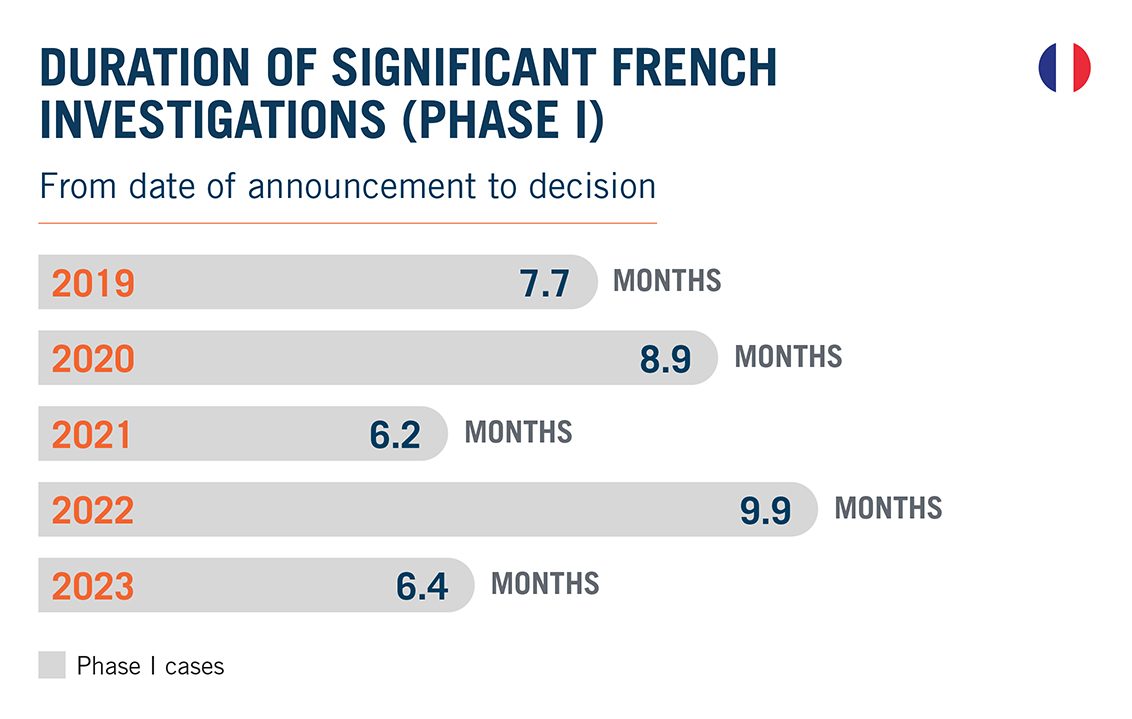

The duration of Phase I reviews ending with remedies decreased by 35.4% in 2023, averaging 6.4 months. This is attributable in a large part to the significant reduction in the period between notification and the proposal of remedies, which dropped to 1.1 months in 2023, compared to 4.6 months in 2022, and an average of 2.9 months over the previous five years. Interestingly, the duration of the pre-notification period in Phase I with remedies increased by 28.1% (4.1 months) compared to 2022 (3.2 months) and 70.8% compared to 2021 (2.4 months). This confirms that the FCA tends to share its competition concerns early in the discussions with the parties, who may then start considering adequate remedies from the pre-notification stage. The FCA still shows a marked preference for structural remedies, which account for three-quarters of Phase I decisions with commitments.8

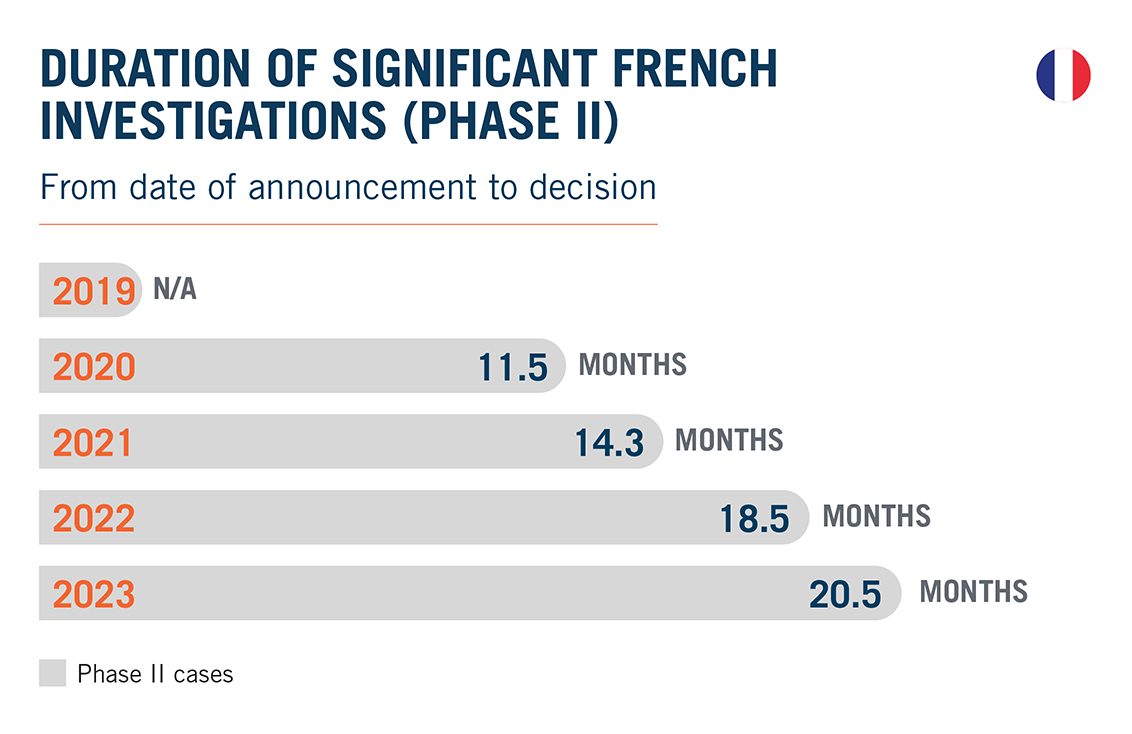

On the other hand, 2023 was marked by a record duration for Phase II reviews, which reached a staggering 20.5 months, a 10.8% increase compared to 2022. The evolution of the Phase II review duration over the past four years reveals an average annual increase of 21.5% in duration year over year (2020-2023) – a trend that is definitely concerning for the merging parties. That being said, the wait may sometimes be worth the while: for the second consecutive year, the FCA unconditionally approved a transaction in Phase II (the creation of a JV in the airport catering sector between Paris Airport and the British caterer Select Service Partner).9 There is no guarantee of success, though: the Euralis/Masaidour and Smartbox/Wonderbox transactions were withdrawn in Phase II after undergoing respectively 21 months and 19 months of investigation, during which the notifying parties failed to convince the FCA that their deals posed no threat to competition.10

2024 at a Glance: Upcoming Thresholds Review Not Expected to Result in Less Enforcement

According to the announcements made President Benoît Cœuré during his New Year address to economic stakeholders,11 merger control activity promises to remain robust in 2024. To address this surge, President Cœuré announced his plan to increase merger control thresholds to account for cumulative inflation, which has been significant since the last reform of the thresholds in 2008.

While it is true that the number of deals that will have to be notified to the FCA may decline because of these changes, parties should keep in mind that the FCA is also considering alternative enforcement avenues. For example, President Cœuré has confirmed that the FCA may rely both on Article 22 of the EU Merger Regulation, which allows the French enforcer to refer deals below the thresholds to the European Commission, and on the Towercast precedent,12 which confirms that national competition authorities can also address mergers under Article 102 TFEU (abuses of dominance), to make sure potentially problematic deals are reviewed, irrespective of the parties’ turnover. The FCA may therefore soon follow in the footsteps of the Belgian Competition Authority, which is the first national competition authority to have applied the Towercast case law so far.13

Simultaneously, the FCA has announced a strategic emphasis on AI and the digital sector as a whole, planning to closely monitor the implementation of the Digital Markets Act (DMA) by large online platforms. As summarized in its 2024-2025 roadmap,14 the FCA promised to use “all the tools available to control merger transactions (using, if necessary, appropriate remedies or, in their absence, prohibiting such transactions” and may not hesitate to refer deals to the European Commission under Article 22.

Finally, 2024 will see a change in leadership for merger enforcement at the FCA. Etienne Chantrel, who has been the head of the merger unit at the FCA since 2017, will be leaving at the end of March. His replacement has not been announced yet but speculations run high as to whether President Cœuré, who comes from a pro-business background, will appoint someone with a different take on enforcement. Any drastic change in the FCA’s approach remains unlikely, but is certainly possible.

Conclusion

When planning transactions that may attract antitrust scrutiny, parties should be prepared for extensive pre-filing discussions with enforcers (the impact on timing may differ between jurisdictions). After a peak in 2022, there was a decline in the average length of Phase II merger investigations in Germany in 2023, returning to durations more in line with those observed in prior years. Conversely, for the third consecutive year, France saw Phase II reviews reach record-breaking lengths in 2023. The steady increase in the average duration of Phase II reviews over the past four years indicates that the environment for parties to transactions may become even more challenging in the future, underscoring the need for careful planning and strategic foresight while keeping an eye on the clock.

The evolving outcome of investigations also poses challenges. Merging parties should not be fooled by the seeming relaxation of competition authorities’ scrutiny. While the FCO eventually cleared all six of the Phase II transactions it reviewed, two required remedies and two of the four remaining unconditional clearances were pulled and refiled. In France, in addition to four cases leading to Phase I remedies and one unconditional clearance in Phase II, the parties were compelled to withdraw their filings to avoid a formal prohibition in two instances. The absence of formal prohibitions should not be any more comforting to those considering deals subject to review in France.

Finally, companies also need to be aware of the new tools that the agencies now have at their disposal to target potentially problematic deals. In France, the FCA has made it clear that it will use the opportunities afforded by the European Court of Justice in the Towercast case to assess non-reportable mergers under Article 102 TFEU. And in Germany, the FCO has been equipped with new tools in the context of the 11th amendment to the GWB. It remains to be seen in the coming years how these tools will impact overall enforcement statistics going forward.

Footnotes

1 FCO, Sector inquiry report: online advertising of 15 May 2023.

2 FCO, Sector inquiry report: municipal waste collection and hallow glass processing of 28 December 2023.

3 FCO, Sector inquiry progress report: provision and marketing of publicly accessible charging infrastructure for electric vehicles of 20 October 2021.

4 FCO, Ad-hoc sector interim report: refineries and wholesale fuel trade of 22 November 2022.

5 BMWK, Comments on the public consultation on the modernization of competition law - further strengthening competition of 23 February 2024.

6 Since 2022, DAMITT data for France includes cases that were abandoned in Phase II. Indeed, experience shows that merging parties may choose to withdraw their filing and abandon the transaction rather than risking a formal prohibition. This reporting is in line with our EU reporting – see the DAMITT 2023 Annual Report: Minding the Gap in Merger Enforcement dated 30 January 2024.

7 FCA, Press release of 31 August 2023, Euralis/Maïsadour.

8 See FCA, Decisions No.23-DCC-32 of 14 February 2023, Vacanceselect/ECG, 23-DCC-57 of 21 March 2023, Gifi/Chamois, 23-DCC-151 of 25 July 2023, Sirestco/Areas.

9 FCA, Decision No. 23-DCC-165 of 3 August 2023, Aeroport de Paris/Select Service Partner.

10 In the absence of an official statement from the Competition Authority, the withdrawal date was estimated to be 15 December 2023, when the parties’ decision to withdraw the operation was made public in the press.

11 B. Coeuré, New Year wishes to economic stakeholders, 18 January 2024, available here.

12 European Court of Justice, Judgment of 16 March 2023, Towercast, case C-449/21.

13 Belgian Competition Authority, Press release of 6 November 2023, Proximus/EDPnet.

14 FCA, 2024-2025 Roadmap, available here.