School is out and it is summertime, which means only one thing in the health policy community: reg season! This is the time of the year when the Centers for Medicare & Medicaid Services (CMS) releases regulations that propose revisions and updates to Medicare payment rates and policies. Since Medicare payment rates often impact corresponding rates and policies used by state Medicaid programs and private insurance plans, these regs are a big, big deal in the regulatory and payment worlds!

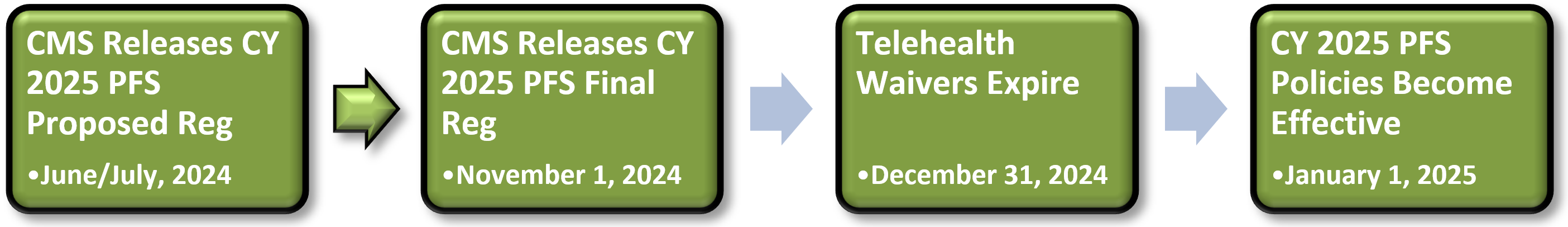

To kick off the summer, my colleagues Kristen O’Brien, Rachel Hollander and I would like to provide a preview of one of the largest annual proposed regulations: the Medicare physician fee schedule (PFS). This year’s reg, which will impact payments for physicians and other clinicians starting in calendar year (CY) 2025, will be released at the end of this month or early next month. Once released, it will go through a 60-day public comment period, after which CMS will revise the reg based on the feedback it receives and then issue the final reg on or around November 1, 2024 – 60 days prior to the start of the CY.

This massive reg is expected to include many different issues, and while we won’t get into every major topic here, we do want to highlight some major issues that are on our radar.

PFS Conversion Factor – Another Cut is Coming

Like last year (and the year before and before…), CMS will likely propose a cut to the 2025 conversion factor (CF) in the CY 2025 PFS proposed reg. While Congress has enacted temporary partial fixes the last four years (see the chart below), its latest fix in the Consolidated Appropriations Act, 2024 (CAA, 2024), enacted in March 2024, is set to expire at the end of this year.

Cuts

As background, the 2024 CF was initially set to be reduced by 2.5%, but Congress offset half that reduction (1.25%) in the CAA, 2023 (enacted in December 2022). The CAA, 2024 provided an additional 1.68% in relief in addition to that provided in the CAA, 2023 (1.68% in relief in addition to the 1.25% already provided, for a total of 2.93%). Since the total relief that was provided, 2.93%, only lasts for one year and CMS is stuck with its current statutory limitations, it must cut at least that amount from the 2025 CF in the CY 2025 PFS proposed reg.

That’s a tough place to start from: a 2.93% reduction. Unfortunately, that’s just the beginning. CMS is required by law to ensure that any changes it makes to specific PFS codes do not increase PFS spending by more than $20 million. Since most changes to codes trigger this “budget neutrality” requirement, every year CMS makes an overall adjustment (usually negative) to the conversion factor. Thus, on top of the 2.93% reduction, CMS will likely make another cut based on budget neutrality. So, the question is: what policies will CMS introduce that will have a big budget neutrality impact?

Last year in the CY 2024 final reg, CMS added a new add-on code for complexity, G2211, that physicians and other clinicians can bill when treating more complex patients in the office or outpatient setting. This single policy caused a budget neutrality adjustment of -2.1%. While we don’t think that CMS will introduce a significant policy that has that large of an impact on budget neutrality in this year’s reg, smaller adjustments to codes and the addition of new codes (such as the 17 telehealth codes described below) can add up and could lead to a percentage point or two in additional cuts to the CF. CMS could also propose certain policies that would have varying impacts on different specialties, such as updating certain clinical labor pricing inputs, refining the practice expense methodology, and fully phasing in the rebased and revised Medicare Economic Index.

While we won’t know the size of the CF cut until we see what CMS proposes, any cut to the CF – which will be on top of CF cuts in previous years – will likely spur the physician community to urge Congress (again) to take action to avoid yet another payment reduction before the start of the new year or to enact broader reform that seeks to remedy this cycle of patches.

Telehealth: What to Do When CMS Needs to Act Before Congress

As described in a previous Regs & Eggs blog post, patients and providers alike are now used to Medicare telehealth waivers that have been in place since the start of the COVID-19 public health emergency (PHE). However, without further Congressional action, Medicare patients will no longer be able to receive most telehealth services in urban areas starting on January 1, 2025. In addition, Medicare patients will need to come to an “originating” site – like a hospital – to receive these services and would no longer be able to receive most telehealth services from their homes.

Although Congress is working on an extension of these policies, CMS in its rulemaking can’t assume that the Congress will take action. In other words, if Congress doesn’t act soon, CMS must assume in the CY 2025 PFS proposed reg that these telehealth flexibilities won’t exist in 2025.

Since the official deadline for Congress to act to extend the waivers isn’t until December 31, it is possible that CMS will go through part or all of the rulemaking process without knowing whether or not the waivers will be extended.

The uncertainty about whether Congress will extend the telehealth waivers (and for how long) will create numerous questions and will definitely cause confusion, especially for patients and providers. Here are some of the issues that may arise in the CY 2025 PFS proposed reg:

- Codes on the permanent or provisional list of Medicare Telehealth Services. Although CMS did not add any new codes permanently to the Medicare Telehealth list in last year’s reg, CMS revised the process for adding new codes to the list and created a “provisional” and “permanent” list. CMS added all the codes that were temporarily put on the list during the COVID-19 PHE on the provisional list, but did not specify a timeline for removing them from that list.

In the CY 2025 PFS proposed reg, it may be more difficult for CMS to make any decisions about what codes to keep on the provisional list or add to the permanent list given the uncertain telehealth landscape, and CMS may therefore decide to punt to next year’s reg to make any significant changes to the current Medicare Telehealth List.

- 17 new telehealth codes recommended by the American Medical Association (AMA) Current Procedural Terminology (CPT®). In March 2023, the AMA CPT voted on 17 new telehealth evaluation and management (E/M) codes that will be in effect starting January 1, 2025. CMS did not address these codes at all in last year’s reg, but may decide to add them to the PFS in the CY 2025 PFS proposed reg.

If CMS does decide to adopt these new codes in the reg, one major question will be the overall impact on budget neutrality. The size of the budget neutrality impact and the corresponding adjustment to the CF depends on how often CMS assumes that the codes in question will be billed. CMS’s inability to assume that the new codes will be billed in urban areas and when patients are located at home may impact CMS’s utilization assumptions and consequently the size of the budget neutrality CF adjustment.

- Reimbursement telehealth services. During the PHE, CMS paid telehealth services at the same rate as the agency would have paid if the service were delivered in person. However, in last year’s reg, CMS decided to phase out that policy, and stated that it would start in 2024 to pay the lower, facility rate for all telehealth services except when patients receive service from their home. In this case, CMS would continue paying at the higher, non-facility rate. Thus, payment levels now depend on the following two place of service (POS) codes: “POS 02, telehealth provided other than in patient’s home,” and “POS 10, telehealth provided in patient’s home.”

In the CY 2025 PFS proposed reg, CMS may decide to pay at the lower, facility rate for all services since CMS can’t assume that patients can continue receive telehealth services from their homes in 2025. CMS could also more fully clarify if or when POS 10 can still be used.

- Other telehealth flexibilities. In last year’s reg, CMS weighed in on some other telehealth flexibilities that were under its discretion to regulate. CMS decided to extend the following waivers through December 31, 2024, to align with the timing of the other waivers:

- Removal of frequency limitations: CMS continued its suspension of frequency limitations for certain subsequent inpatient visits, subsequent nursing facility visits and critical care consultations furnished via Medicare telehealth.

- Direct supervision: CMS maintained its current definition of direct supervision to permit the presence and “immediate availability” of the supervising practitioner through real-time audio and visual interactive telecommunications.

- Supervision of residents in teaching settings: CMS continued to allow the teaching physician to have a virtual presence in all teaching settings only in clinical instances when the service is furnished virtually.

- Flexibility for providers’ home addresses: CMS continued to allow flexibility in documentation requirements when providers bill for telehealth out of their home office or other location for privacy reasons.

Since CMS may not know for how long Congress plans to extend the other telehealth waivers, CMS may wind up extending these waivers for a longer or shorter period of time than the other waivers are eventually extended for, creating some misalignment in the timing of all the telehealth policies.

The Merit-based Incentive Payment System, Alternative Payment Models and the Medicare Shared Savings Program

Merit-based Incentive Payment System – What to Expect on Quality Reporting

CMS could propose some big changes to the Merit-based Incentive Payment System (MIPS), the major quality performance program for physicians in Medicare, for the 2025 performance period. Since the program started in 2017, it has faced an uneasy path. Because of the COVID-19 PHE, hardship exemptions were in place for the 2019, 2020, 2021, 2022 and 2023 MIPS performance periods. In addition, due to the Change Healthcare and Ascension cybersecurity attacks, clinicians are also able to exclaim a hardship exemption this year in 2024. Thus, 2025 may be the first year in a long time when clinicians won’t have a viable opportunity to opt out.

CMS is making MIPS more challenging each year. For the last few years’ performance periods, the performance threshold (the point score out of 100 that clinicians need to achieve to avoid a penalty and receive a bonus) has been set at 75 points. CMS proposed in last year’s reg to increase it to 82 points for the 2024 performance period but ultimately decided to keep it at 75 points. The agency did signal, however, that it could increase the threshold in future years, so we would not be surprised to see CMS propose to increase the threshold to 82 points (or something similar) for the 2025 performance period. A higher threshold could be especially challenging for small and rural providers who may have claimed hardship exemptions the last few years and may not have the resources necessary to receive a high performance score. There are also likely to be significant refinements to the MIPS categories, with the Cost category gaining a lot of concern from stakeholders as well as questions on how to better address topped-out quality measures, which are removed from the Quality category.

CMS will also likely make some changes to an alternative reporting option in MIPS called the MIPS Value Pathways (MVPs). MVPs allow clinicians to report on a uniform set of measures on a particular episode or condition to get MIPS credit. This option just started in 2023, and CMS will probably make some tweaks to existing MVPs and propose new ones. CMS’s goal is to eventually sunset traditional MIPS and move completely to MVPs, but the agency has yet to lay out a timetable for doing so. CMS may propose such a timeframe (such as 2027 or 2028) in this year’s reg. However, given that there are only 16 MVPs that are currently available, and the uptick of MVPs has been slow, stakeholders may want CMS to provide a compelling argument for why we are ready to fully transition to MVPs.

Alternative Payment Models (APM) and Moving Towards Risk

CMS may decide to propose some tweaks to how clinicians are determined to be a qualifying APM participant (QP). In order to be exempt from MIPS and qualify for an Advanced APM bonus, clinicians must provide at least a certain percentage of their payments or care for a certain percentage of their patients through the Advanced APM. Clinicians who meet this threshold are called “QPs”. While QP status has always been determined at the Advanced APM entity level rather than at the individual clinician level, in last year’s reg, CMS proposed to make all QP determinations at the individual level. Most physician groups opposed the proposal, as they believed that this change would make it even more difficult for specialists to meet the QP thresholds. CMS wound up not finalizing the proposal, but could propose it or a similar proposal again in this year’s reg.

Medicare Shared Savings Program

Every year, CMS proposes changes to the Medicare Shared Savings Program (MSSP), the national accountable care organization (ACO) program. Although CMS has restructured MSSP to include various tracks for more experienced ACOs who want to take on more financial risk (i.e., more risk, more reward), some entities have pushed the agency to go a step further and introduce opportunities for full capitation and financial options that are only now available in the CMS Innovation Center model, ACO Reach. CMS may therefore propose such an option in the reg.

Well, that’s our preview of the PFS proposed reg! While some big-ticket items from last year’s reg, such as the add-on code for complexity, split and shared evaluation and management services, and the elimination of the appropriate use criteria program, may not be addressed in the CY 2025 PFS proposed reg, there will still be plenty of proposals and requests for information that will keep everyone in the health policy community busy. So… Get ready for some more large helpings of Regs & Eggs during reg season!

Until next week, this is Jeffrey (and Kristen and Rachel) saying, enjoy reading regs with your eggs.

[View source.]