We are now more than a full quarter into 2025, and it has been a very busy start to the year for the CWT fund finance practice, thanks in part to a busy quarter for secondaries fund finance deals. This is on the back of an important year for the product. The private equity secondaries market continued its steady evolution in 2024 in a way that was both familiar and transformative. Familiar, because the themes of recent years—liquidity constraints, innovation in deal structures and the rise of GP-leds—continue to dominate conversations. Transformative, because the numbers and trends coming out of 2024 suggest that secondaries are no longer just a reactive asset class. These trends have continued through the first quarter of 2025. Once viewed as a niche liquidity solution, secondaries have now become a proactive strategy in their own right, as secondaries funds represent some of the largest fund launches in recent years and secondaries products are no longer used just to manage exposures but a critical asset class used to pursue strategic opportunities across market cycles.

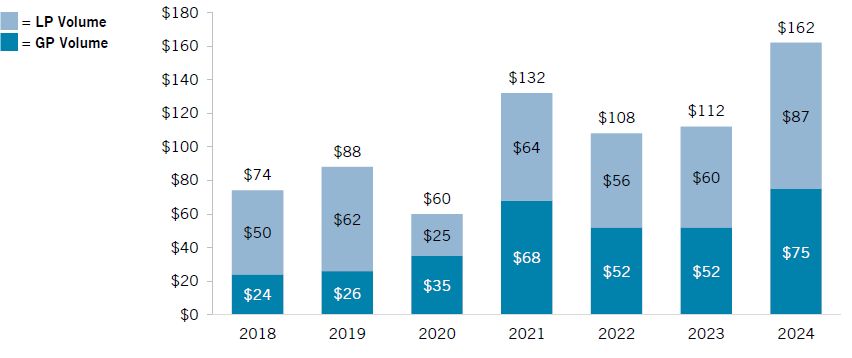

According to Jefferies’ Global Secondary Market Review, secondaries volume exceeded $160 billion for the year, establishing 2024 as the most active year on record for secondaries. LP-led transactions accounted for roughly 53% of volume, rebounding from prior-year lows, while GP-leds represented nearly 47%.

Source: Jefferies’ Global Secondary Market Review

GP-Led vs. LP-Led: Two Tracks, One Destination

An important part of the secondaries market maturation has been the rise of more complex and customized liquidity solutions. These are often bifurcated into two different transaction types “LP-led” transactions and “GP-led” transactions. While these terms are not necessarily standardized in their usage, LP-led transactions generally refer to secondaries transactions initiated by investors, for example, a large pension fund looking to sell a portion of their private equity portfolio to rebalance their investment portfolio exposures. GP-led transactions instead refer to sponsor initiated secondaries transactions such as continuation fund launches, asset strip sales and tender offers.

GP-leds: Sophistication and Strategic Use

GP-led transactions have matured into a sophisticated, strategically deployed part of the secondaries ecosystem. Continuation vehicles remain the dominant structure, accounting for the bulk of GP-led volume, buoyed by both single asset and multi-asset structures. Sponsors’ use of continuation vehicles continues to represent an increasing proportion of total private equity exits as the M&A and IPO markets remain subdued. Sponsors turned to GP-leds not as an opportunistic liquidity play, but as a value-maximizing strategy for high-conviction assets. While once the subject of controversy and often viewed with skepticism by LPs, the increasing normalization of continuation vehicles in the market along with sponsors increasingly focusing on transparency, interest alignment, more robust bid processes, LP communications and even additional structural flexibility (e.g., providing existing investors with options to retain their current investment terms in addition to the traditional options of either exiting or rolling their investment into the continuation vehicle) have helped with increasing acceptance by LPs.

LP-leds Rebound as Pricing Recovers

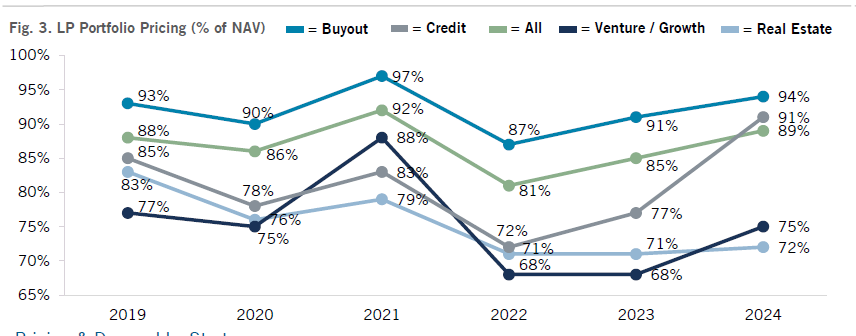

After a relative slowdown in 2022 and early 2023, LP-led secondaries transaction volume rebounded in 2024. Increased pricing was certainly another theme in 2024 driven by all time highs in public market valuations as well as new entrants into the secondaries market place, most notably evergreen funds.

Source: Jefferies’ Global Secondary Market Review

LP-led deals remain more straightforward structurally than their GP-led counterparts. However, we continue to see secondaries investors increasingly expand their asset coverage focus with dedicated funds to cover co-invest interests, credit secondaries and even continuation vehicle secondaries.

So what does this mean for Fund Finance?

As secondaries market volumes continue to increase, we are similarly seeing an increasing use of debt and leverage across secondary transactions. Demand for financing portfolio acquisitions continues to remain strong, as does financing to facilitate continuation fund acquisitions with a notable uptick in volumes in the second half of the year. Faced with persistently high asset prices and elevated return hurdles, buyers turned to financing to enhance IRRs and improve capital efficiency. This was especially prevalent in GP-led deals involving high-quality assets, including both single asset and multi-asset continuation vehicles, where lenders were more willing to underwrite NAV-based credit facilities or through the use of subscription and hybrid credit facilities where lenders were more comfortable underwriting high-quality anchor investor capital commitments.

We continue to see leverage used for LP-led deals as well, both in the form of debt facilities and buyer provided financing (i.e., deferred purchase price arrangements). We have also seen an uptick in adoption of NAV-based financing by secondaries sponsors that have not traditionally used leverage. Most notably a large increase in liquidity facilities provided to evergreen funds as they have proliferated throughout the secondaries market in the last couple of years.

Looking Ahead: 2025 and Beyond

Coming into the year, the outlook for 2025 suggested continued momentum in the secondaries market, supported by both cyclical and structural tailwinds. This was consistent with our first quarter, which saw robust deal volume for financing both LP-led and GP-led transactions. Until the M&A markets and IPO markets rebound, demand for liquidity solutions and portfolio rebalancing is expected to remain strong.

We expect to see continued innovation in GP-led secondaries with more bespoke structures and even greater emphasis on alignment and governance in order to increase LP buy-in. LP-leds are poised for further growth, particularly as institutions seek to proactively manage exposures across vintages, sectors and strategies, which may be exacerbated by current market dislocations if investors once again find themselves overallocated to private investments given distress in public markets. Nonetheless, macroeconomic uncertainty may have a temporary dampening effect on volume as bid/ask spreads increase in light of global trade disputes and depressed public market valuations. This could provide opportunities for financing and structured solutions to help bridge the gap in the interim.

Perhaps most importantly, the perception of secondaries is shifting permanently. No longer a niche product for distressed sellers or a tool of last resort, the market has matured into a vital liquidity and portfolio management mechanism—one that sponsors, investors and advisors are integrating more fully into their portfolios and long-term strategic planning.