Substantial changes to the European life sciences and healthcare regulatory landscape are expected to reshape the sector. EU regulators have outlined a raft of reforms to modernise regulatory architecture, simplify product approval processes, enhance patient safety, and improve access to innovative health products. These reforms will affect multiple sub-sectors, from pharmaceutical companies to MedTech and service providers, touching on areas from the regulation of products, to health data and artificial intelligence.

While many of the changes promise to boost innovation, others may have the opposite effect, as well as increasing costs and impacting investment strategies. Anticipation and preparation will be key for sponsors seeking to successfully navigate these developments.

What Is Happening in European Life Sciences and Healthcare Regulation?

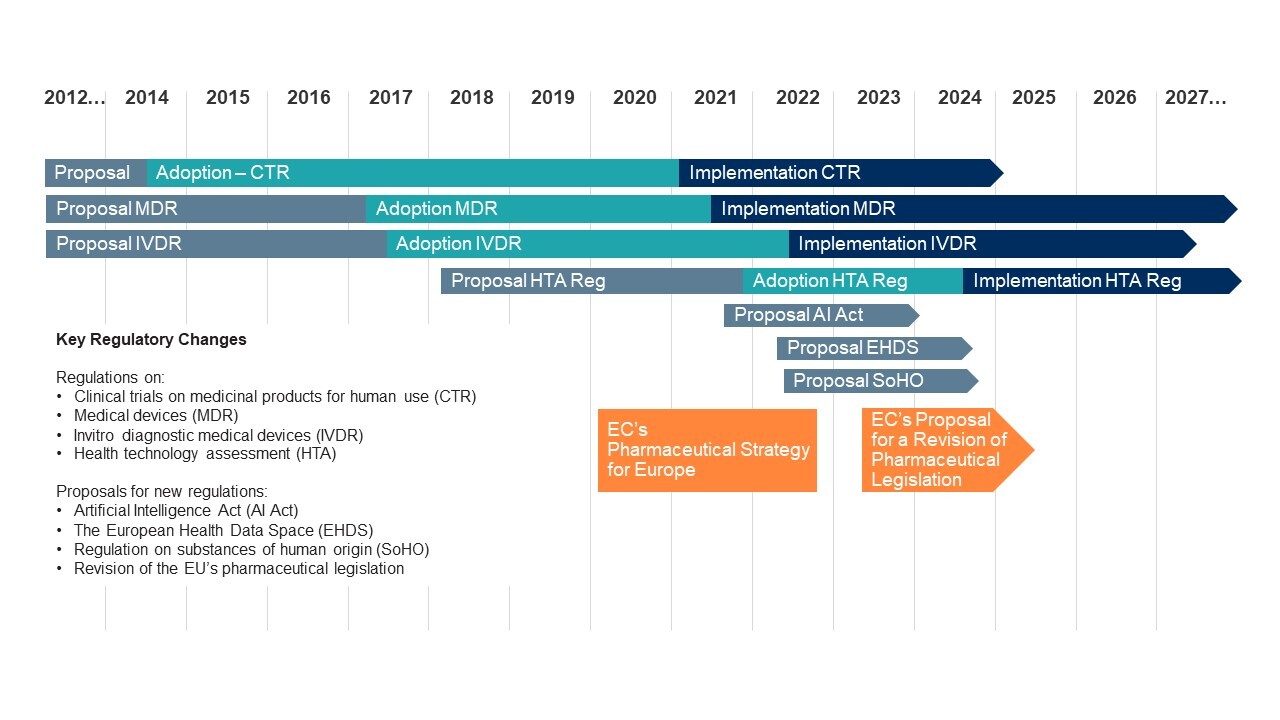

Dealmakers face an evolving situation — some changes have been recently enacted, while other sector-specific framework reviews are currently underway or are in the early stages of the EU legislative process (see below).

The recently announced overhaul of the EU’s pharmaceutical legislation — key among the anticipated changes — is set to significantly impact investment. The proposals target improved and faster EU-wide access to new medicines and are expected to streamline the lengthy EU approval processes, while also reducing the basic market exclusivity period (so-called “RDP”) for new medicines from the current eight years to six years. Notably, any extension to the six-year period, if available, is expected to be limited and conditional (depending on factors such as maintaining EU-wide access or meeting an unmet medical need). This will impact financial return profiles for those medicines that do not obtain an extension. Reduced exclusivity periods and greater interference in R&D may be particularly detrimental to emerging companies with more limited resources and less certain financial potential/output.

Regarding already enacted legislation, such as the Medical Devices Regulation, we have seen unintended consequences of implementation begin to emerge — including the need for extension of compliance deadlines to mitigate product shortages, and reports of smaller companies struggling to adapt to higher compliance costs. We expect further effects will be felt as more changes are adopted.

Negotiating a Changing Landscape

As sponsors and portfolio company management teams assess and prepare for the regulatory overhaul, the volume of new developments underlines the need for expert advice on these topics. We anticipate changes to development pipelines, product launch timelines, market share dynamics, and financial returns, both in the mid- to long-term. A hands-on approach is crucial, including early review of management planning and assessment of the likely impact on each specific asset. Existing investment models and acquisition playbooks may also need to be adjusted as sponsors and other market participants assess deal terms, valuation, and exit prospects — presenting both challenges and opportunities. Sponsors that are well prepared stand to get ahead of the competition.