In our most recent edition of the OLNS, we shared findings of an empirical study of Growth Share programs in German start-ups. In this Snapshot, we summarize some of the highlights of our little analysis.

The Analyzed Data Set, Assumptions and Limitations

We obtained thousands of articles of associations for German start-ups that raised financing rounds between 2018 and July 2024. While we initially obtained this data set to analyze meaningful patterns in the composition and development of advisory boards in German start-ups over several financing rounds (the results can be found here), we also did a key word analysis to identify articles of association that contained provisions for Growth Shares. If the articles of association contained provisions on Growth Shares, the relevant shareholders' lists were additionally obtained from the electronic commercial register.

With respect to the various assumptions we made and the limitations of both our data set and the methods we used, we kindly refer you to the main publication.

Total Numbers and Naming

In total, we identified 66 companies whose articles of associations referred to some form of Growth Shares. Half (33) of the companies used the term "Hurdle Shares". This is followed by 20 companies that used "NLP Shares". Seven companies referred to "Growth Shares", while two companies used the terms "Zero Shares" and "Subordinated Shares", respectively. One company uses the term "Management Shares", and another refers to this class of shares in their articles of associations as "Common Shares with Negative Liquidation Preference".

Which Companies Issue Growth Shares?

65 out of the 66 companies in our analysis are organized as limited liability companies (GmbH). Only one company is structured as a stock corporation (AG).

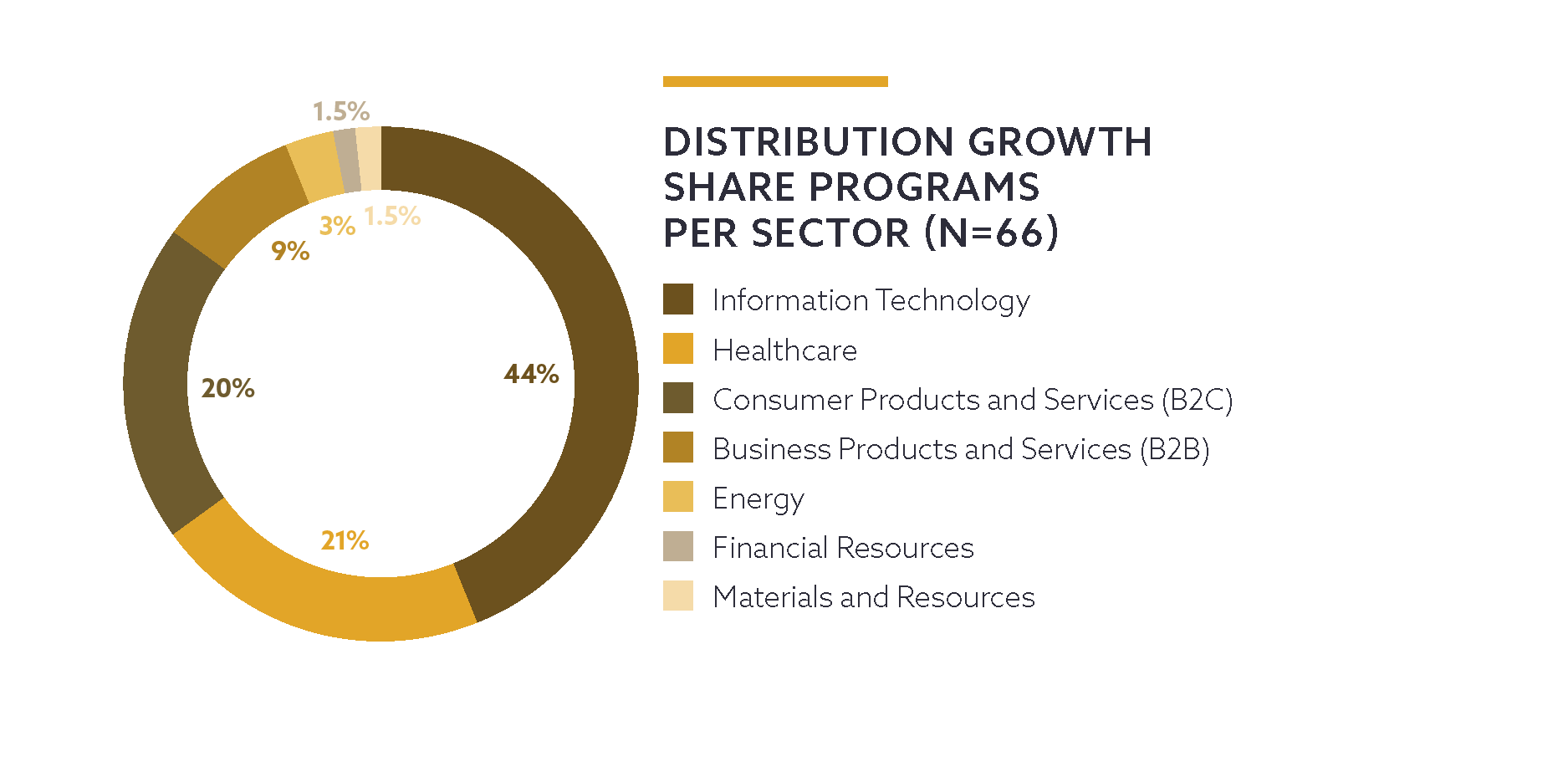

When examining the business sectors and industries of the companies in our data set, the following distribution emerges: The largest group, comprising of 29 companies (approx. 44 %), belongs to the "Information Technology" sector. This is followed by the "Healthcare" sector with 14 companies (approx. 21 %). Next is the "Consumer Products and Services (B2C)" sector, which includes 13 companies, making up about 20 %. "Business Products and Services (B2B)" follows with six companies (approx. 9 %), while the "Energy" sector includes two companies (approx. 3 %). Lastly, there is one company each in the "Financial Resources" and "Materials and Resources" sectors (each approx. 1.5 %).

In Which Stage are Growth Shares Issued?

We also looked at the financing stage of the companies when they issued Growth Shares for the first time (when they issued Growth Shares at various points in time, we considered the first issuance to be the relevant one for our categorization).

Of the 66 companies in our data set, 28 (approx. 42.5 %) had raised a Series Seed as their last financing round when they issued Growth Shares. Another 23 companies (approx. 35 %) were in Series A. Four companies (approx. 6 %) were in Series B, Series C and Series D stage, respectively. Two (approx. 3 %) were in Series Pre-Seed, and one company (approx. 1.5 %) was in Series E.

How Many Growth Shares are Issued?

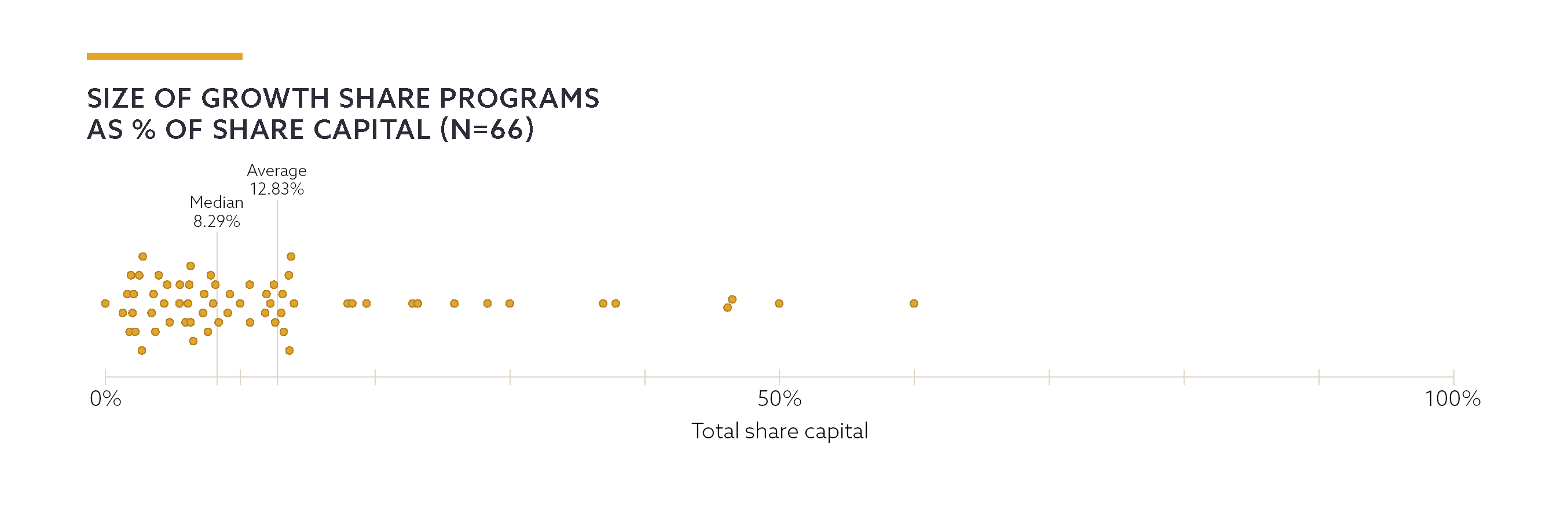

We also looked at the proportion of Growth Shares issued relative to the total share capital of the company at the time of issuance. Among the 66 companies examined, the smallest percentage of initially issued Growth Shares was 0.00027 %. The highest percentage was 60 %. On average, 12.83 % of the share capital was issued as Growth Shares, with a median of 8.29 %.

The following graphic illustrates the distribution we found:

Who Gets Growth Shares?

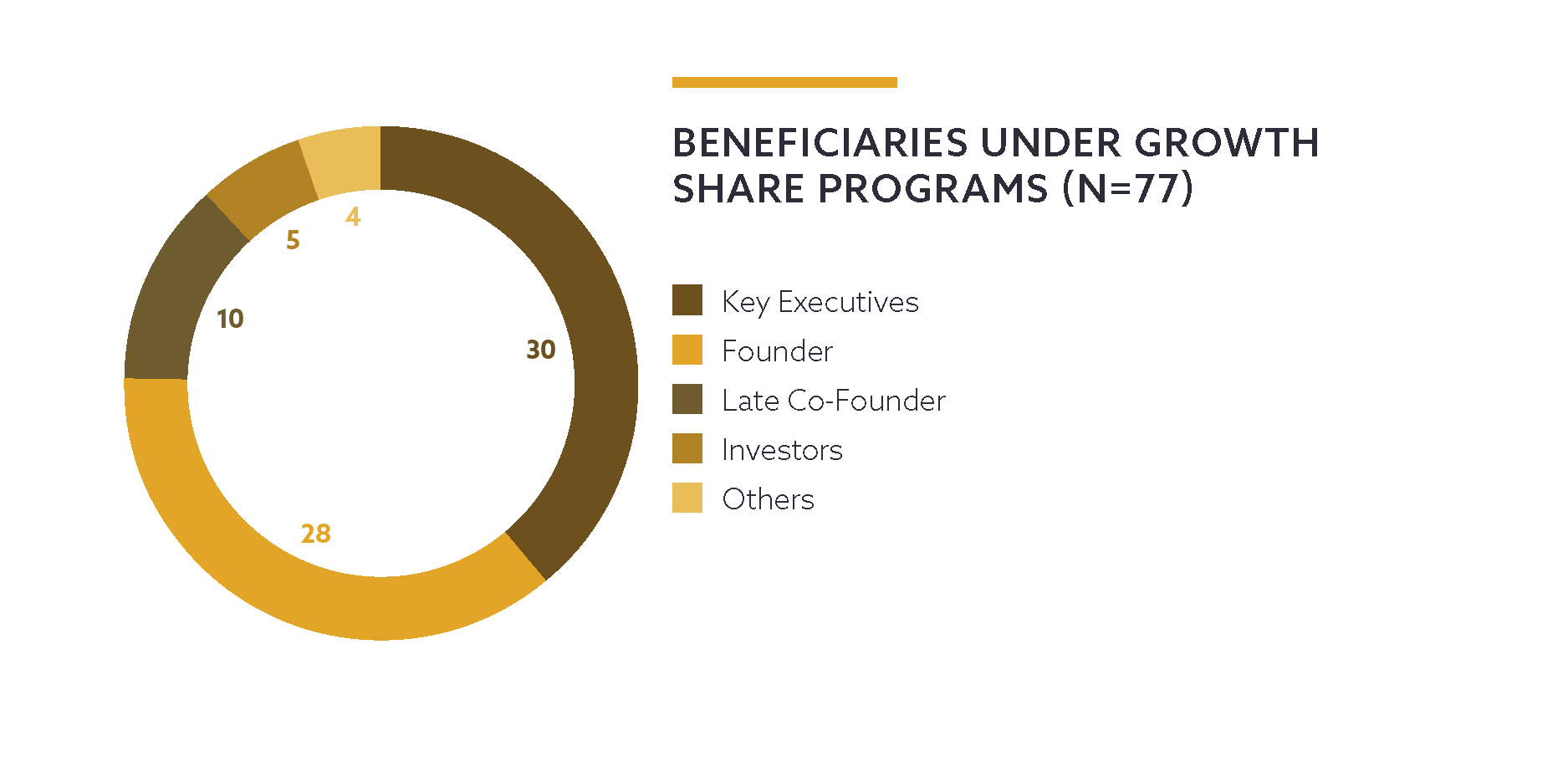

Number of Beneficiaries: On average, Growth Shares were granted to 1.7 Beneficiaries. The range spanned from ten Beneficiaries to just one Beneficiary.

Categorization of the Beneficiaries: We also attempted to categorize the recipients. For this classification, we relied not only on commercial register information but also on other sources such as the companies' websites and the LinkedIn profiles of the Beneficiaries. We understand that the distinctions are fluid and that the categorization is, of course, somewhat subjective (which is lawyers' Latin for arbitrary). We distinguish the following categories:

- Founder

- Late Co-Founder

- Key Executives

- Investors

- Others

In some cases, companies issued Growth Shares to multiple Beneficiaries who belonged to different categories, resulting in multiple entries. With this in mind, the empirical findings are as follows:

In 30 cases, Growth Shares were issued to Key Executives, with four of these allocations made through a ManCo. Founders received Growth Shares in 28 cases. The "Late Co-Founder" category accounted for ten allocations of Growth Shares, although, as mentioned, the distinction between Founder and Late Co-Founder is not clear-cut. Investors received Growth Shares five times. In the "Others" category, we recorded four allocations, where recipients included, among others, advisory board members (including the advisory board chairman) and nonvoting observers on the advisory board.

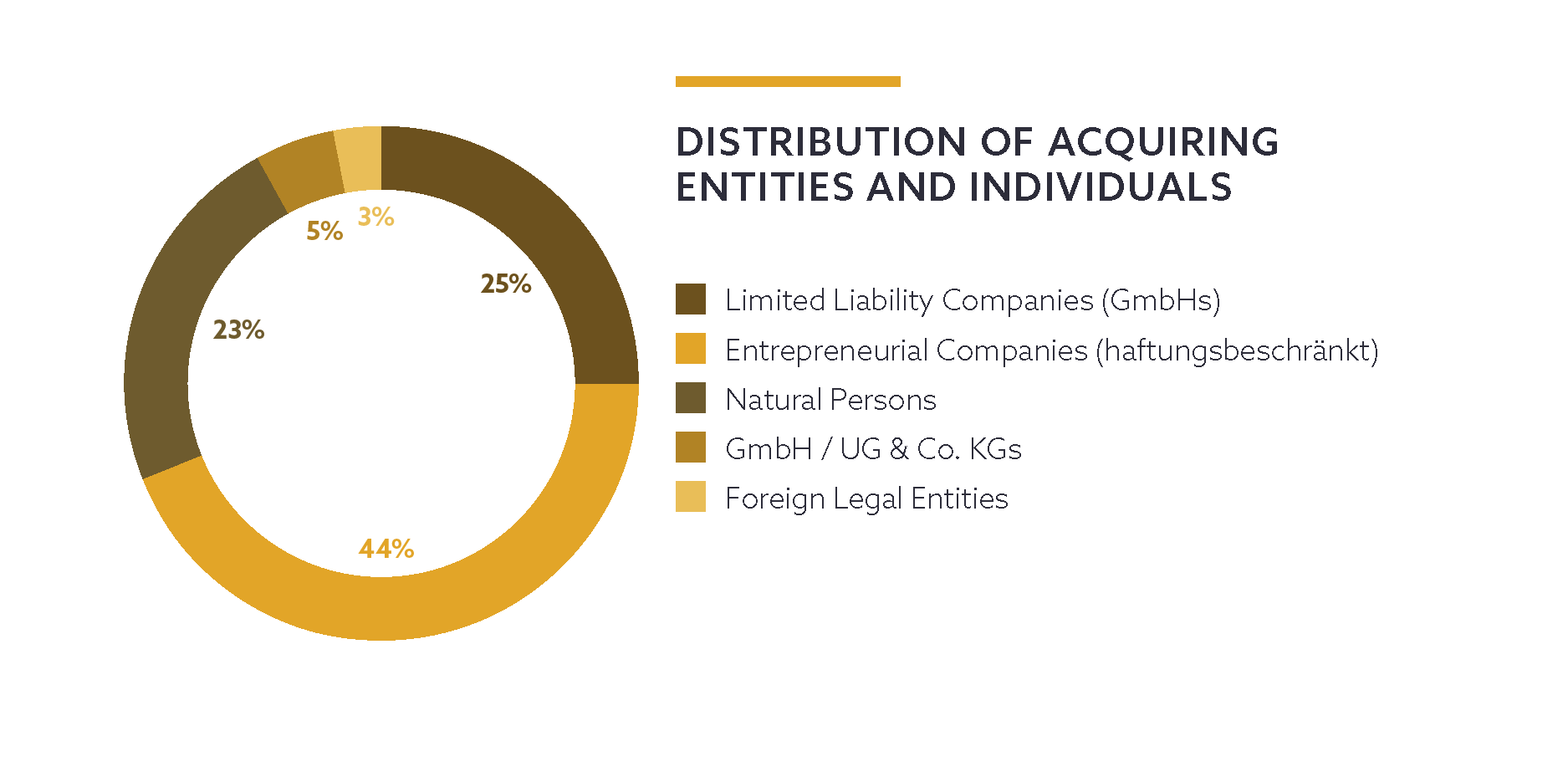

Acquisition by Corporations and Partnerships: On the acquirer side, we found 25 % limited liability companies (GmbHs), 44 % entrepreneurial companies (haftungsbeschränkt), 23 % natural persons, 5 % GmbH/UG & Co. KGs, and 3 % foreign legal entities such as LLCs and B.V.s.

Findings on Hurdle Amounts

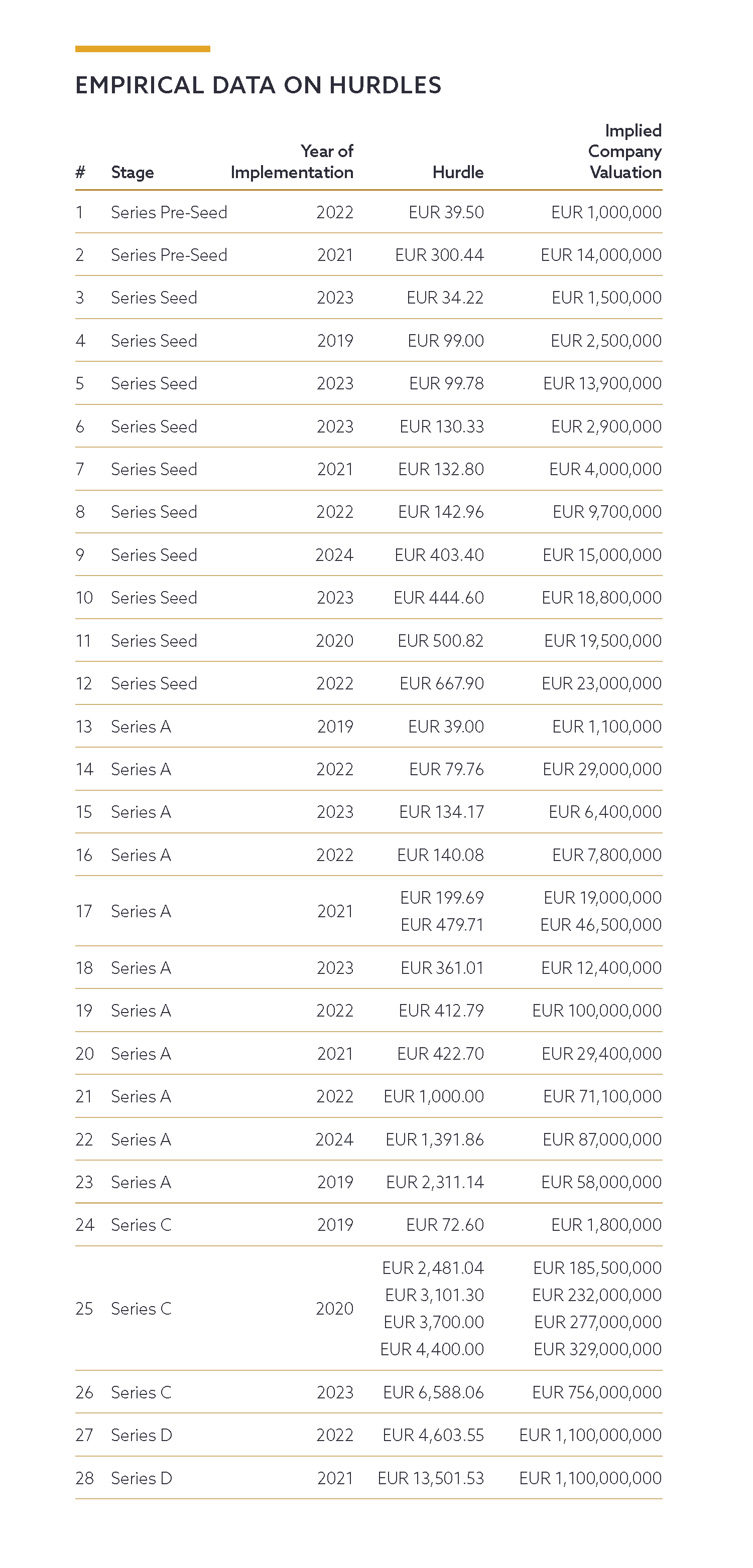

In a total of 28 identified articles of association, a specific Hurdle was mentioned. In two cases, even multiple classes of Growth Shares with different Hurdle amounts were mentioned (in one case two and in the other case four classes). In three cases, the Hurdle was not specified as an amount per Growth Share but as a total amount. We then converted this into a Hurdle per Growth Share by dividing it by the number of the issued shares existing immediately before the issuance of the Growth Shares.

The sample size is too small for statistically reliable statements. Nevertheless, we want to present the results found in the table below.

[View source.]