Southeast Asia is of growing importance to the global electric vehicle (EV) supply chains and both Thailand and Indonesia have great ambitions for the EV industry to drive domestic growth. However, the mining and processing of minerals critical to EV batteries is accompanied by a set of risks that must be addressed by both governments and the private sector. This article explores how to mitigate supply chain risks associated with the growing demand for EVs.

The Future is Electric

Southeast Asia’s electric vehicle (EV) market is booming. Since 2019, EV sales in the key markets of Thailand, Vietnam, and Indonesia have increased exponentially, reaching year-on-year growth rates of 300 – 400% in 2023.1 However, these figures are due in large part to a low starting base. In Thailand, which is leading the pack, EVs accounted for only 5,685 of total (cumulative) vehicle registrations in 2020.2 In 2023, this number rose to 131,856, a 23-fold increase in three years.3

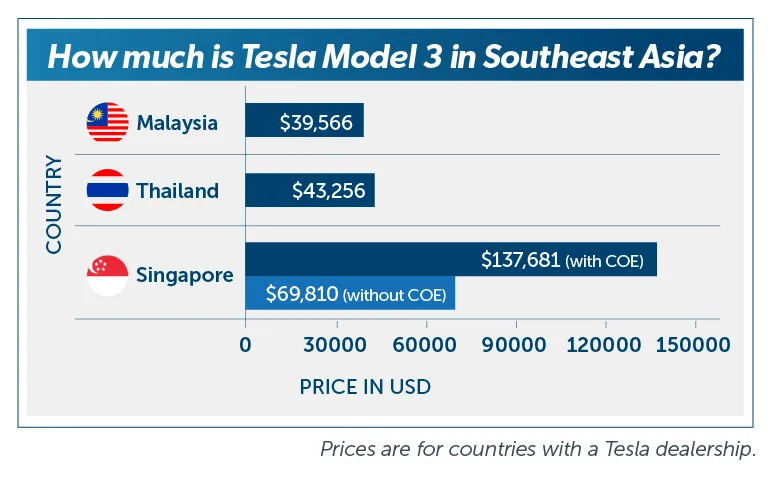

What’s driving this increase? With more affordable products than their Western counterparts, Chinese automakers are benefiting the most from the surge in EV sales in Southeast Asia.4 In Malaysia, where Tesla prices are among the lowest in the world, a basic BYD EV model such as the Dolphin is just over half the price of a Tesla Model 3, or MYR 99,900 (around USD 21,200).

On the policy side, regional governments are nudging consumers towards EVs with tax rebates, cash incentives and policies to phase out combustion vehicles within coming decades as part of their decarbonization or low carbon plans. These attempts to shape consumer behaviours are driven by the need to balance expected growth in motorisation ratios (registered motor vehicles per 1,000 people)5 against the environmental imperative to reduce emissions from the transportation sector, which is the second-most energy-intensive6 sector across the region.7

Rolling Off Assembly Lines, Linking Up to Global Supply Chains

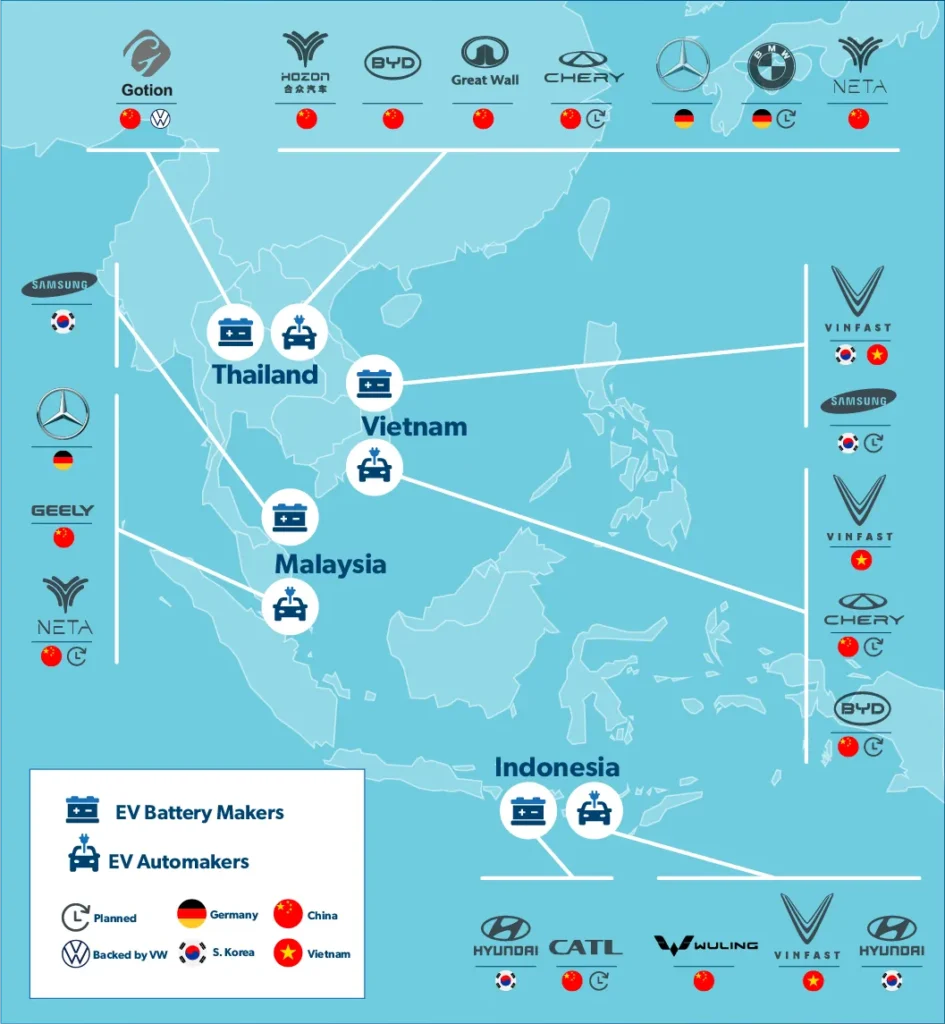

The growth in regional EV markets is accompanied, and possibly outshined, by its increasing importance in the industry’s supply chains. While this is especially true for Chinese automakers, other major EV makers such as Tesla, Hyundai, BMW, and Mercedes Benz also have supply chain exposure to Southeast Asia.

In Thailand, China’s BYD, Great Wall Motors (GWM), and Hozon have capitalized on the country’s strong automotive industry. GWM’s first overseas plant, in the automotive hub of Rayong, saw the first domestically produced EV roll off the assembly line in early 2024, while Hozon commenced in-country production in late 2023. They have been joined by BYD, which began production at its Thai factory in July 2024.8 These three automakers will eventually have combined annual capacity of close to 300,000 cars a year.

Thailand may have plans to become the region’s EV hub, but it is not without competition. Hyundai and Wuling began assembling EVs in Indonesia in 2023 and in the same year, outgoing president Joko Widodo outlined ambitious plans to produce 600,000 EVs domestically by 2030.9 With the world’s largest deposits of nickel, a key mineral in EV batteries, Indonesia has capitalized on its competitive advantage by having buyers process and refine the ore domestically. It is also building out its position in EV supply chains with policies to attract investment in both battery and EV manufacturing. This strategy is paying off; by some estimates, foreign direct investment (FDI) in the country’s manufacturing industry has increased 10-fold since 2011. With investment in the metals industry leading the way, FDI in mining is not far behind.10 The country’s build-out of the EV supply chain is in progress: in early July, a new EV battery manufacturing plant was launched in West Java.11

Meanwhile, Vietnam is home to one of the fastest growing EV manufacturers (and for now, the only homegrown EV manufacturer in the region), Vinfast, which plans to open a factory in Indonesia.

Global Supply Chains, Local Issues

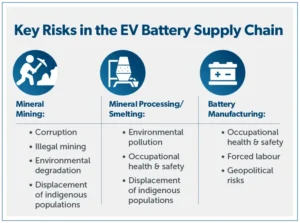

The economic and environmental importance of EVs to Southeast Asia is clear, but the industry is not without ethical, legal and regulatory issues due to the current battery reliance on nickel, which is a critical component in lithium-ion batteries. Nickel mining in Indonesia has similar issues that generally plague the mining industry, including environmental degradation, deforestation, land disputes, illegal mining, and corruption. The recent case of private businessmen and senior officials in the Ministry of Energy and Mineral Resources being convicted of illegal mining and corruption in the issuance and sale of nickel mining permits in Southeast Sulawesi is just one example of the ills that hover around nickel mining.12

The hazards that surround the country’s nickel processing industry also are well-documented. There have been a spate of horrific industrial accidents at nickel smelters, with the most severe incident resulting in dozens of injuries and almost 20 deaths.13 Meanwhile, workers and communities around nickel smelters – many of which have their own coal-fired power plants to generate electricity – have endured respiratory illness and severe rashes from coal dust for years.14

Refinery operations also may displace Indigenous populations by clearing rainforests in remote areas. In late June 2024, after a year-long campaign led by an NGO against expansion plans that could displace an uncontacted tribe, French miner Eramet and German chemical company BASF announced that they would shelve plans for a US $2.6 billion refinery complex in the Moluccas islands.15 Many of the smelters in Indonesia are owned by Chinese companies, but a recent Bloomberg investigation suggests that Indonesian nickel is present in the supply chain of almost every major EV manufacturer, including Tesla and Hyundai.16

Maker Beware

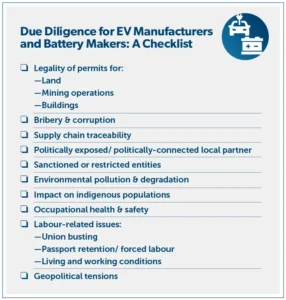

With electrification and decarbonization goals being pursued by many Southeast Asian countries, EVs are likely to continue their growth trajectories. However, as the region’s importance in global EV supply chains grows, EV manufacturers have a responsibility to conduct thorough due diligence to minimize their exposure to environmental and labour-related issues in their Southeast Asian supply chains. This obligation is already mandated by recent legislative developments in the EU that requires large companies to conduct supply chain due diligence, identify human rights and environmental issues, and take remedial actions.17 Any automobile company looking to sell vehicles in Europe will need to understand all aspects of their supply chain and mitigate any risks associated with sources.

Even where there is no legal requirement to conduct such due diligence, doing so would be wise and may help mitigate reputational and financial risks. Environmental firms and activist investors increasingly are holding global companies accountable. This accountability cannot be offshored as global sourcing simply increases supply chain risk. Accountability campaigns, including the Greenpeace campaign against Indonesian palm oil, and efforts to raise awareness of child labor in the Congo’s Cobalt mines, have harmed many corporate reputations.

EV manufacturers should not wait for similar campaigns to take action in their own operations.

What You Can do to Mitigate Your Supply Chain Risk

Many companies already are mitigating their supply chain risks and many more will start doing so in response to the European regulations. At a high level, mitigating your supply chain risk requires:

- Knowing your exposure. Answer questions including:

- What risks is your organisation vulnerable to?

- Who are your suppliers (Tier 1)?

- Who are the suppliers of your suppliers (Tier 2, Tier 3 suppliers)? What are their business practices?

- Who are your local business partners?

- What stakeholders are involved?

- Driving remediation. Clauses on adherence to global ESG standards can and should be embedded in contracts with suppliers, along with zero-tolerance policies against bribery and corruption.

- Monitoring & audits. Periodic reviews and audits of Tier 1 suppliers and below can help your organization monitor compliance with regulatory and ethical requirements, as well as surface any previously unidentified issues that may need to be addressed.

At its core, supply chain risk mitigation requires thorough supply chain due diligence that delves into who you are doing business with and what their business practices are. While complex, unraveling such risks and working to address them can be the difference between a business poised for sustainable growth, and one marred with controversy and misgivings in the long-term.

1 https://en.antaranews.com/news/307389/indonesias-two-wheeled-ev-sales-surge-262-percent-in-2023; https://www.nationthailand.com/business/automobile/40034866; https://iea.blob.core.windows.net/assets/a9e3544b-0b12-4e15-b407-65f5c8ce1b5f/GlobalEVOutlook2024.pdf

2 https://www.boi.go.th/upload/content/Smart_EV.pdf

3 https://www.nationthailand.com/business/automobile/40034866

4 https://www.reuters.com/business/autos-transportation/chinese-automakers-retain-grip-over-southeast-asias-booming-electric-car-market-2024-06-21/

5 Vehicle ownership ratios in Indonesia (485 registered vehicles per 1000 persons in 2020) and Vietnam (44.6 registered vehicles per 1000 persons in 2020) in particular are likely to rise. https://www.iseas.edu.sg/articles-commentaries/iseas-perspective/2022-112-mapping-the-surge-in-ev-production-in-southeast-asia-by-tham-siew-yean/ https://en.vneconomy.vn/vietnam-seeing-rapid-growth-in-car-ownership.htm and https://en.antaranews.com/news/307428/indonesias-automotive-industry-has-potential-to-grow-bigger-ministry

6 According to the latest ASEAN Energy Outlook report (2022), oil is by far the primary fuel source for transportation, accounting for 91% of energy consumption in the sector.

7 https://asean.org/wp-content/uploads/2023/04/The-7th-ASEAN-Energy-Outlook-2022.pdf

8 https://carnewschina.com/2024/07/04/byd-dolphin-assembled-in-thailand-as-byds-8-millionth-nev

9 https://indonesiabusinesspost.com/risks-opportunities/indonesia-aims-to-produce-electric-vehicles-by-2004-targeting-600000-units-by-2030/

10 https://www.businesstimes.com.sg/international/asean/indonesias-ev-battery-bet-benefiting-regional-supply-chain-shift-report

11 https://www.reuters.com/business/autos-transportation/hyundai-motor-lg-energy-solution-launch-indonesias-first-ev-battery-plant-2024-07-03/

12 https://www.bbc.com/indonesia/articles/c06elxp0g22o

13 https://www.voaindonesia.com/a/korban-tewas-ledakan-tungku-smelter-di-morowali-naik-jadi-18-orang-/7412669.html

14 https://walhisulteng.org/ambisi-hilirisasi-nikel-dan-masifnya-penggunaan-energi-fosil-batubara-di-sulawesi-tengah/

15 https://www.scmp.com/week-asia/health-environment/article/3269420/indonesia-gets-wake-call-step-sustainability-efforts-nickel-industry

16 https://www.bloomberg.com/features/2024-indonesia-sulawesi-nickel-fire/?embedded-checkout=true

17 The European Council formally adopted the Corporate Sustainability Due Diligence Directive in May 2024. The CSDDD applies to companies with turnover of more than EUR 450 million and 1000 employees and will enter into force in stages from 2027.