WHAT WE'RE SEEING

In this edition of The Download, we dive into insights from SXSW, where we had the chance to talk with Jim Rabuck at the Defense Innovation Unit, Sean Voigt, founder of Austin Climate Hub and David J. Neff, partner at Ecliptic Capital. These conversations explore how innovations in defense tech are meeting the needs of service members, why the free market for renewable energy in Texas is creating so much demand and how companies are working at the intersection of AI and climate tech to solve for energy demand. We also take a closer look at the AI “halo effect” on stock prices and share insights from our partner Jamie Moore’s interview on Bloomberg Daybreak, where he discusses trends in the 375+ venture capital investments on which our team advised across Europe last year.

01 How Defense Tech Is Evolving and Harnessing User Input

02 Why Renewable Energy Is Booming in Texas

03 How AI and Hardware Innovations Are Disrupting Climate Tech

04 In the Penumbra of AI: Examining the Reach of the AI Halo

05 European Venture Tech Outlook

06 The Download Quiz: The Market for Secondaries

/ 01

MARKET PERSPECTIVES

Jim Rabuck, the regional director of the Defense Innovation Unit, sat down with Orrick’s Montana Ware to shed light on how agencies within the U.S. Department of Defense are integrating privately funded technology and how technology companies can adapt to the current federal acquisitions landscape.

How Defense Tech Is Evolving and Harnessing User Input

-

Montana: I'm Montana Ware. I'm an attorney at Orrick. I work in our technology companies group. And I'm based in Austin, Texas. I work with a lot of defense companies, with VCs and other investors who are interested in defense. This is my friend, Jim Rabuck, he's with the Defense Innovation Unit. Jim why don't you tell us a little bit about what you do at the DIU.

Jim: So my focus, Regional Director inside DIU, I also lead the Defense Innovation Community of Entities. What that means is think like Army Applications Lab, AFWERX, NavalX, DARPA, there's about 130 of them. My job is, how do I herd the cats? How do I get them to focus on strategic efforts that matter for national security?

Montana: So when was the DIU first started? It's a pretty new agency, right?

Jim: So go back to 2016, Ash Carter, working with the president says, bottom line, Department of Defense moves way too slow, takes years to acquire technology, takes years to get it in the hands of the warfighter. The bottom line is that we're just not moving fast enough. So DIU gets stood up. And what it first started as is, can we go connect with the absolute best technologies in Silicon Valley that VCs have invested in, and can we get it pulled into the DoD? We went from a $30 million organization back in 2016 to now just over a billion dollars.

Montana: Do you guys ever encounter any legal or regulatory red flags or concerning things that you would sort of advise the companies you work with, the companies you talk to, to go seek counsel on, CFIUS, facilities clearance, ITAR, what do you see?

Jim: All the time. From a standpoint of where we try to help sherpa them through the process, absolutely, that is one of the key areas. Like, great, you got a product. There's some significant hurdles that you got to get through to actually get into the hands of a warfighter.

Montana: What can defense founders and early-stage defense companies do to help maximize their chance of success when they're trying to sell to the DOD?

Jim: You have to find who's the user that absolutely needs this? Like, who is the guy that is using the product? Then you have to figure out who's the agency that's actually going to buy the product. Usually that's an entirely different organization that has no idea who that user is. If a startup can walk into the room knowing who that user is and have that user bought into what they're doing, that accelerates the process significantly.

Montana: If you are a tech company that develops defense technologies or dual-use technologies in 2010 versus 2025, what are the differences in that acquisition process, in that sales process, and are our technology companies, are our tech founders today, are our new defense startups today in a better position than they were 15, 20 years ago?

Jim: The bigger companies in 2010 were very entrenched in the way that they were able to get contracts. They'd been doing it for years, hiring senior leaders out of the Department of Defense, and a lot of times able to get into that requirements process early. What it looks like today is that the end user has a voice, and what I mean by end user is the warfighters that are out there in the combatant commands and on posts, their voices are heard by the companies, whether startup or big prime, they have the ability to go get answers for themselves. And now it's kind of, I wouldn't say democratized, but it's made it much easier for venture-backed startups and the small businesses to get access to the contracts that they need.

When we talk about DIU and when we talk about why we exist, you can go down to that “why.” It's that we have an adversary. They are a peer with us in many, many ways. And our goal is to make it so that it is so painful for them that if they choose to start a war with us—it really just comes down to that they don't want to start a war with us because of the decisions we've made beforehand.

Montana: There's a concept of never letting it be a fair fight.

Jim: Yeah, absolutely. You want to have every advantage and every possibility. So when we start looking at, you know, competition in China, we can make bets now to stop any sort of aggression from China or our adversaries.

This is why we exist. We exist to help the best commercial get into the hands of warfighters. And if you have a product that can work with us, we're here. We'll make it fast.

Montana: Amazing.

Jim: Thanks for having me.

Montana: Thanks as always, Jim.

/ 02

MARKET PERSPECTIVES

Sean Voigt, the founder of the Austin Climate Hub and a director at EarthX Capital – both organizations dedicated to strengthening the clean tech ecosystem – joined Orrick’s Zac Padgett to discuss why renewable energy is generating high demand and the potential for distributed energy resources.

Why Renewable Energy Is Booming in Texas

Zac: Hi, Zac Padgett here, partner at Orrick. I'm here with Sean Voigt, founder of the Austin Climate Hub, Director at EarthX Capital. We find ourselves here at South by Southwest 2025. Lots of people in town to talk about tech and innovation, in particular around clean tech, climate tech, energy tech. What are you hearing about the most? What's top of mind for everybody?

Sean: Yeah, one thing that everyone's been talking about for a while, and obviously including here at South By, is load growth. Just to put this in context, here in Texas, our peak load is about 85GW. And we've been adding maybe like 1 to 2GW a year for quite a time now. We are set to almost double that amount in the next five years. So up to 150GW on the low end up to 110, maybe 130, up to 150GW. So that's like 50GW of new load by 2030.

Zac: And what's driving that generally?

Sean: So great question. You hear a lot about the role of data centers and AI and compute. That is a big deal. But it's actually also just other economic growth in particular sort of at the industrial and the commercial levels. So for instance, Houston, is set to literally double its entire you know, energy, demand. And that's primarily actually sort of the port, other types of commercial industrial, not so much actually data centers. So it is a whole mix.

To get a kind of a sense for where this load is going to get filled all you need to do is take a look at the interconnection pipeline. The interconnection pipeline is about 200,000MW or 200 gigs of different types of projects that are trying to basically get you know, interconnected into the grid. Of those 200,000MW, like 10,000 to 15,000 are gas and everything else is wind and solar. Probably some battery in there as well. Meaning so basically 95% of everything the market is telling us it is trying to build in and is going to build is basically wind, solar and battery.

And the reason for this is multiple but very simple. Number one, they are the cheapest and the fastest to build sources of energy end to end from sort of idea to sort of you know, electrons flowing. It's about three years for solar and wind minimum five years for a gas project.

Zac: There's a huge backlog for getting gas.

Sean: Exactly. And so even taking that aside, the supply chain for gas is, you basically can't buy a generator.

So, you know, Texas has this energy fund, this $5 billion sort of slush fund of super low-cost loans, pretty much, I think, thrown as a bone to the oil and gas industry to build these guys peaker plants.

Zac: Ostensibly to build some more baseload, right?

Sean: Yeah. Exactly. For dispatchable load. We've seen NG basically pull out saying we can't actually fulfill this.

NRG, which is the largest energy producer integrated energy producer and utility in the state of Texas, 100% gas company in terms of like what they build in their portfolio, they had to literally sign an agreement with GE Vernova that makes gas turbines and another company, almost to like vertically integrate back into gas. And if you look into that contract, they were going to only get two turbines delivered before 2030.

Zac: Just before we were looking at the ERCOT app right.

Sean: Yeah.

Zac: It showed what the current fuel mix is for power generation in Texas. And it's currently 80% low carbon, which is really interesting, on a regular day.

Sean: Yeah. Texas is number one in solar, number one in wind, about to be number one in battery. So we dominate California and basically everyone else. This is a state where we have a market design, which is 100% just based on price and a competitive market. Right? We don't mandate renewables, we don't subsidize renewables. We simply say, if you can build generation capacity, I don't care what it is, and you can get it in there, we'll buy it if it's the cheapest thing. And in that context, renewables win every time.

Zac: Yeah, I mean we were talking a little bit about just trying to break down why these renewables projects are a lot cheaper in the long run.

Sean: Solar, wind, battery. They eat everything. You simply cannot compete. You cannot compete with zero marginal cost. Ten years ago, cost for energy storage was about $1,000 per kilowatt hour. We just hit $50 last year. And we are rapidly approaching 25 bucks per kilowatt hour for storage.

Zac: Yeah, and then battery storage can also be located in strategic places.

Sean: 100%. The transmission and distribution grid to basically get generation to the point of load, I mean, we basically build this entire machine in order to… it is designed for the one minute out of the entire year when you've got all the air conditioners on or it's super cold. Right. And so this issue around congestion and how do I get my generation over here to there is incredibly elegantly solved by I think the second big theme that is a really big deal, but not being talked about as much as the load discussion, which is the role of distributed energy resources.

Batteries are a really important one. Rooftop solar is another one. And, you know, I think a really exciting theme that I think I am excited about is the way that we are starting to see these decentralized resources start to actively participate in the grid edge. This is one thing where it is truly, at least at a system level, truly, win-win. It is deflationary on costs, it is massively stabilizing to the grid in terms of reliability, and it inherently favors clean energy.

Zac: Yeah, it's an incredible time. Well Sean, thank you so much for joining us. It's really good to talk to you about all of this.

Sean: Yeah, I love talking about this stuff. Thanks so much for the opportunity.

/ 03

MARKET PERSPECTIVES.

David J. Neff, a venture investor, who spearheads investments in climate change and energy transition, joined Zac Padgett to explore the cutting-edge technologies being developed to meet the needs of AI-driven power demands.

How AI and Hardware Innovations Are Disrupting Climate Tech

Zac: Zac Padgett here with David Neff to talk a little bit about what we're seeing at South by Southwest, in particular around clean tech, climate tech and energy tech.

David: Looking forward to it. Thanks for having me.

Zac: I understand you've got a lot of experience in the space, and you've been out on the streets this week checking out a lot of events.

David: Yes.

Zac: What's top of mind? What's kind of the buzzwords that are floating around?

David: You know, it's interesting, right? If you break it up by sector, I think the overall theme surprise, surprise for everyone watching this is AI. And not of the AI is replacing you, but just every software you can imagine having AI sprinkled on it. I think the AI stuff is really interesting given there is the potential if things go the way that a lot of people are predicting, for it to have a huge impact on the problem of climate change.

Another I was hearing about is you know, wave power. One of the main issues with wave power is trying to understand where the waves are going to be coming in, what the wind direction is. Lots of challenges, lots of opportunities at the same time.

Zac: Well, maybe we can talk a little bit about what we're seeing among founders and investors.

David: Yeah, I mean, I've probably been to the last ten or so South Bys you know, for people watching this, I do think South by Southwest is what's happening two years from now, three years from now. It's a very future innovative, forward-facing conference. And my hope is a lot of the climate stuff we're seeing, wave energy technology, you know, hey, this is this new material for solar panels. It's lighter. This is the better inverter that has AI in it that's helping you know, with the solar panels, all of that is being talked about right now, built right now. It's probably not yet ready for funding right now, but it's a great time to be like, oh, I need to keep an eye on that.

Zac: One I want to talk about in particular is geothermal. Here I'm hearing a lot this this South by Southwest, about new technologies that would allow us to dig deeper, to potentially pull power in sites you wouldn't think. And this would be you know, clean, renewable power. I mean, have you been hearing anything about that as well?

David: Yeah. I mean, it's definitely the year for it, right? I think one of the ways you can judge popularity of events is, is there a house about it? Right? Here in Austin you know, we have Rainy Street and a lot of the bars and restaurants get rented out for these houses. And the same with our downtown district for those of folks watching at home in Austin, get rented for these big events, which is great for them.

And for the first year ever there was a geothermal house. And I was on another panel earlier in South by Southwest, and they talked about a startup called Thunderstone, and Thunderstone's creating underground lightning to simulate fracking, to get access to those hot rocks, as you put it. Right.

Zac: Underground lightning.

David: Yeah, I know.

Zac: That's the title of my new album. And thinking back a few years, I think, you know, the hydrogen economy was something that people were very, very excited about. So, you know, when I think about geothermal, I think it has the similar story arc.

David: What do I worry about in that particular is hydrogen is constantly stuck in a hype cycle. I worry about geothermal falling into that of like it's the new bright shiny object. It's super interesting. I hope it's like, no, this makes sense. We're going to build one. We're going to try it. We're going to go for it, right? Texas is going to be a fantastic place for geothermal.

Zac: Well, I think you're right that Texas is a good place to try some of these experiments because it's been a great place for wind and solar.

David: Yeah, absolutely. You know, the beauty of Houston and Austin and I think Dallas is coming around to it as well, is funding and funds that think about climate, funds that actually put dollars into climate, and don’t just talk about it. I've judged a couple of competitions at the University of Texas here in Austin, not just on startups, but on climate startups and a 22-year-old with the next big idea for a climate startup as an undergraduate is just blows me away.

And so to me, that's also very exhilarating and makes me very happy and proud for the next generation. That a climate entrepreneur could be the next trillion-dollar business 20 years from now. Who's at one of those schools right now. Right? Or not even at a university, right, just has the great idea and is going to go solve it.

I would add, and you and I have been talking a lot about hardware. Right. And there's so much other room in material science. There's a lot of super interesting material science companies out there that are solving climate and thinking about climate. And then the other category is software. If you're building the next generation of climate software, I think Austin's a fantastic place with a lot of talent and a lot of people behind that, too.

Zac: Well, thank you so much, David, for your time.

David: Of course. Thank you for having me.

Zac: All right. Cheers.

/ 04

A CLOSER LOOK

In the Penumbra of AI*

Examining the Reach of the AI Halo

We’ve all seen it, or at least we think we have. Whenever there is a major announcement related to AI, it feels like the wave floats (or sinks) a wide swath of public company stocks. Some of the correlation is clear – there are a few key stocks that have become synonymous with the “AI effect” in the public consciousness, and casual stock watchers often look to those first to gauge the broader impact of an AI announcement. However, the “AI ecosystem” consists of a diverse array of companies, including those supporting AI development (whether software or hardware), others using AI to deliver their own products and services, still more developing AI solutions to help other companies solve their own problems and many others. If there seems to be one constant, it’s that the outer bounds of the “AI ecosystem” are continuously in flux, with companies entering (and leaving) the chat all the time.

So, how far does the “AI halo” really extend? When there is a notable positive development, does the rising tide lift any public company that has ever, in the dark of night, uttered “AI…” or is there a limit to the penumbra of the AI star?

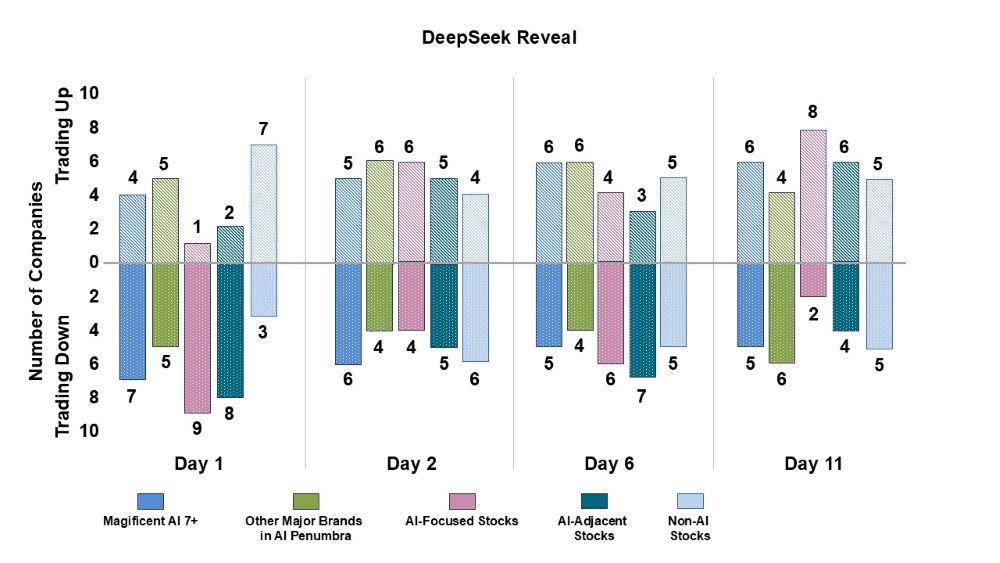

To examine this effect in more detail, Orrick’s Mark Mushkin analyzed 40+ public companies grouped into four categories:** the “Magnificent AI 7+,” “Other Major Brands in the AI Penumbra,” “AI-Focused Companies” that use AI to deliver their products or services and “Significant AI-Adjacent” stocks, including those that support other companies’ AI use or provide AI-based support for other industries, such as autonomous driving. We also selected a group of companies from traditionally non-AI industries (retail, manufacturing, chemicals, etc.) to serve as a control group and ensure any notable effects were not merely the result of general market movements at the time.***

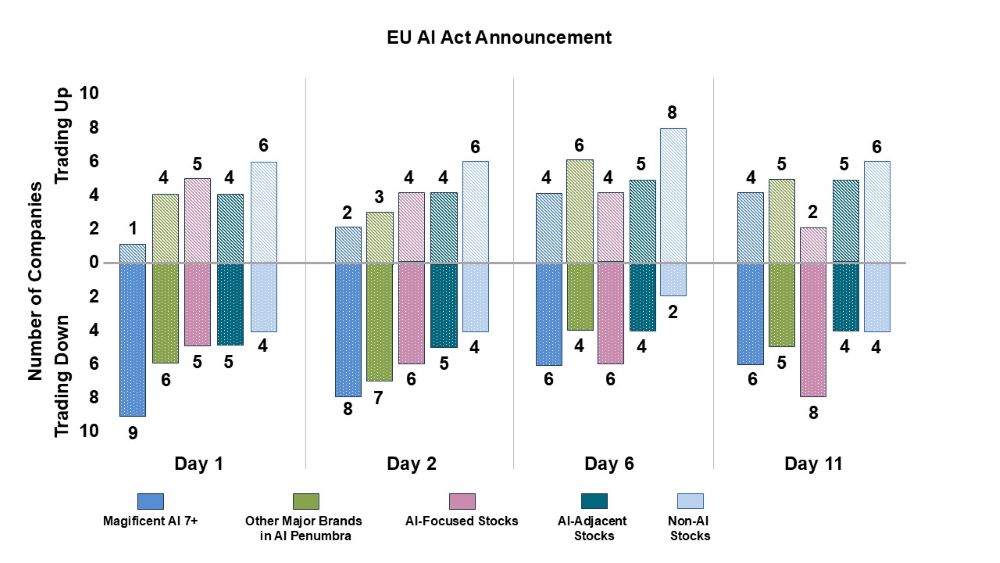

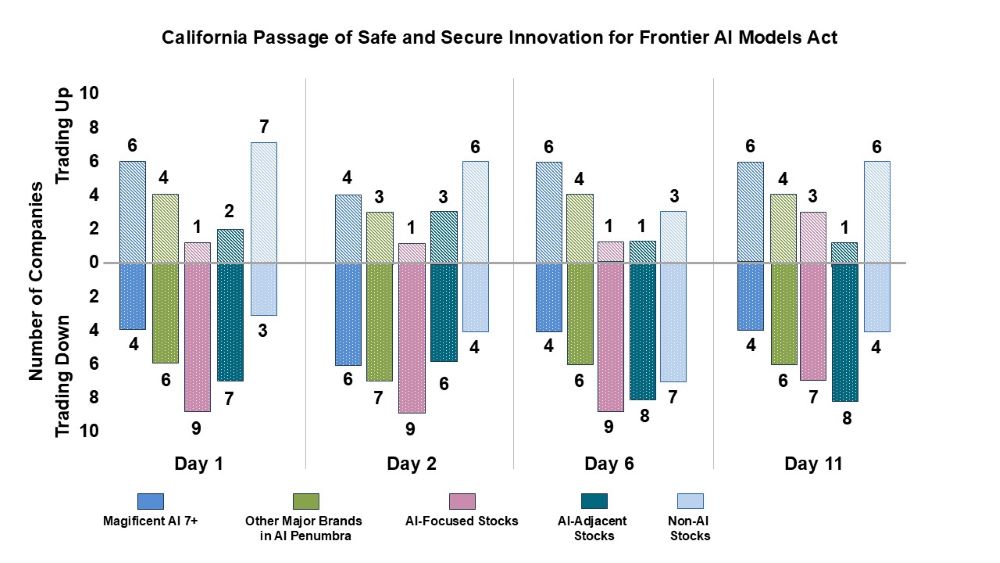

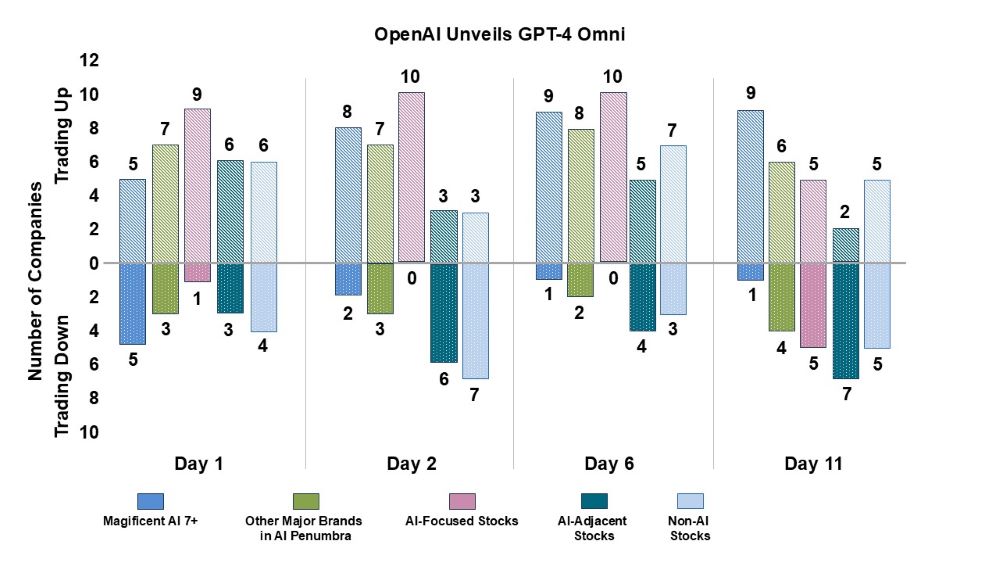

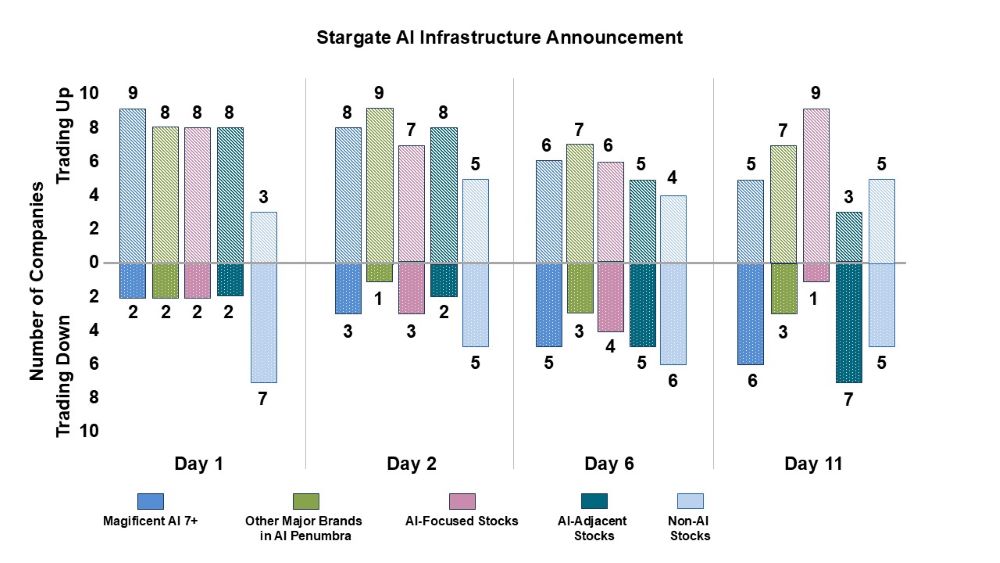

We then picked five events that seem to have moved the “AI needle” in the eyes of investors over the past two years and looked at stock price movement in our dataset on the day of (Day 1) and one (Day 2), five (Day 6) and ten (Day 11) trading days after the announcement, charting changes compared to their closing price on the trading day before the event. Specifically, we looked at:

- The announcement of the EU AI Act – 3/13/2024

- OpenAI’s unveiling of GPT-4 Omni – 5/13/2024

- California’s passage of the Safe and Secure Innovation for Frontier Artificial Intelligence Models Act – 5/21/2024

- The Stargate AI infrastructure announcement – 1/22/2025

- The reveal of DeepSeek’s capabilities – 1/27/2025****

The first takeaway is that the “AI penumbra” effect is real, although the impact did not uniformly filter through the different categories of AI and AI-related companies on an event-by-event basis.

For example, following the EU AI Act announcement, the control set was relatively flat, with an average positive increase of <1% and 6 of the 10 companies trading up. In contrast, 26 of the 39 companies in the AI-linked dataset (excluding a few not yet listed) traded down on Day 1 and Day 2, with an average decrease of ~1% and 3.75%, respectively. Interestingly, the effect was short-lived, with trading across the full AI-linked dataset returning mixed results by Day 6, including stock price recoveries by some companies that initially traded down. The impact was also most pronounced across the “Mag AI 7+” and “Other Major Brands” datasets, possibly due to these being multinational companies with more perceived exposure to the EU (though this is just speculation).

A similar story played out when we looked at the CA AI Act, but in the inverse across sub-groups. On Day 1, the same overall number (26) of the 39 companies in the AI-linked dataset traded down, rising to 28 on Day 2, while the control group returned slightly positive overall gains. However, in the case of the CA AI Act, the result was more keenly felt across the AI-focused and AI-adjacent stocks (16 of 19 traded down immediately), while results across the two ‘major brands’ groups were mixed but slightly negative. The announcement of GPT-4 Omni about a week earlier had a broadly positive impact (27 / 28 of 39 trading up on Days 1-2) with mixed results across sub-groups, as the ‘AI-focused’ companies experienced an outsized average increase of 5% on Day 1 and 8.6% on Day 2 (compared to more modest 1 – 2% average gains for the others)… only for half of the set to reverse their gains by Day 11 following the announcement of the CA AI Act.

|

|

Alternatively, we saw a “cleaner” example of the AI bump in the recent Stargate announcement. On Day 1, 33 of the 41 companies in the AI-linked dataset traded up 3.27% on average, dropping to 32 on Day 2, but with an average increase of 4.63%, while the control set again remained relatively flat. This result was consistent across the full AI-linked dataset, with only two companies trading down in each sub-group. Notably, the balance across the AI-linked dataset largely equalized by Day 6, with only 24 companies still trading up and 17 trading down, and similar results at Day 11.

Finally, DeepSeek – which we thought would be one of the most prominent examples of AI “groupthink” (at least if the press at the time were to be believed) – did initially yield the expected riptide. 29 of the 41 AI-linked companies immediately traded down on Day 1, highlighted by NVDA’s 17% drop and an average decrease of 6.4% overall, as compared to positive movement of ~2% for 7 of the 10 companies in the control group. However, the impact was most pronounced across the AI-focused and AI-adjacent datasets (17 of 20 trading down) as compared to the “major brands” groups (12 of 21 trading down) and we were surprised to see a very quick reversal – potentially a correction to perceived overreaction? – with 22 of the 41 AI-linked companies trading up by Day 2, including 11 each of the ‘major brands’ and ‘AI-focused / adjacent’ companies, with results remaining relatively evenly mixed after that.

|

|

|

Where does this leave us? At the least, there appeared to be clear examples of the AI waves impacting companies across the ecosystem in the near term, most notably on Day 1 and Day 2 after a major announcement. However, as with any wave, the impact smoothed as it got further away from the epicenter, and the waters returned to their (un)steady state within five to ten trading days. In addition, the varying impact of some events across our sub-groupings suggests that the rising tide does not, in fact, lift all boats equally – and that, while a bellwether, it is not uniformly the case that as go the Magnificent (AI) 7(+), so go all AI stocks. While some events are perceived to be sufficiently seismic that the impact is felt across the AI ecosystem writ large, investors do appear to consider how much a particular announcement is likely to impact a given company without assuming every negative development affects every AI-linked company, and vice versa. The scope of the impacts varies event-to-event, but it seems true that the AI star does throw off flares that move the market, at least until cooler heads (and maybe some sunglasses) prevail.

*All figures based on rough lawyer math and stock price movements as of March 15, 2025.

**You say “arbitrary selection,” I say “random sample set.” In looking for trends, we ran general searches for public stocks associated with AI, pulling from various “AI watch lists” to come up with ~40+ companies that we grouped loosely into categories for purposes of our analysis. It is very possible your “favorite AI company” is not in our dataset or had a different reaction to our benchmark events, or that you find our groupings less than scientific, but our goal was to capture a broad spread of companies linked with AI in public / investor sentiment.

***Magnificent AI 7+: NVDA, IBM, GOOG, MSFT, AAPL, META, DT, TEM, MU, TSM, ASML; “Other Major Brands in AI Penumbra”: AMZN, ADBE, NFLX, TSLA, ORCL, PLTR, DDOG, DE, CRM, SNPS; “AI-Focused Companies”: PATH, S, UPST, SOUN, RXRX, AI, ODD, BBAI, INOD, PRO; “Significant AI-Adjacent Stocks”: KVYO, QUIK, VERI, NOW, BRCHF, ANET, IOT, AUR, MBLY, WRD, PONY; “Control Group”: CAT, LMT, GM, DD, LIN, WMT, COST, RIO, NKE, UNH. With a few exceptions, the two “major brands” categories had market caps >$100B, the “AI-focused” category had market caps between $10B and ~$1B and the “AI-adjacent” category was mixed, with market caps as low as ~$100mm and as high as >$100B.

****While DeepSeek released its model about a week earlier, Jan. 27th was the first trading day after awareness of the DeepSeek development seems to have penetrated the market.

A Closer Look is a regular feature in The Download – as Mark Mushkin shares insights into the rapidly evolving ways issuers attract and raise capital. You can find his previous post here: Is the Death Spiral a Myth?

/ 05

MARKET PERSPECTIVES

European Venture Tech Outlook

Bloomberg Daybreak sat down with Orrick’s Jamie Moore to discuss insights from the firm’s leading role last year in the $52B European venture market. They look at the most active verticals, the impact of AI and trends in deal terms.

Watch the conversation.

/ 06

THE DOWNLOAD QUIZ: THE MARKET FOR SECONDARIES

What percentage of the funding rounds that we advised on in the European venture tech market in 2024 included a secondary component?

A) 9%

B) 22%

C) 30%

D) 37%

Check the answer here.

[View source.]