Key Takeaways

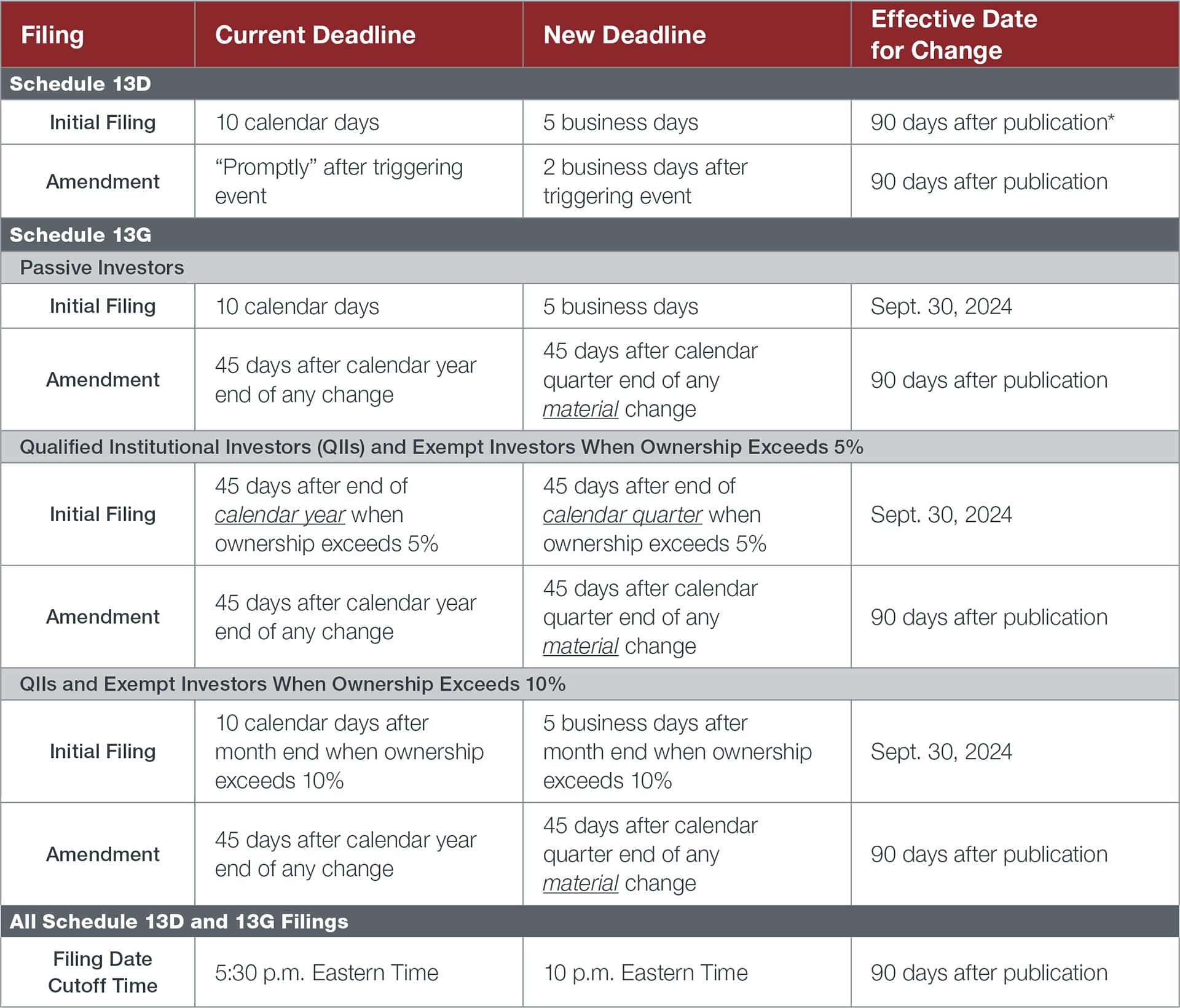

- The U.S. Securities and Exchange Commission (SEC) adopted amendments that will accelerate the filing deadlines for (i) Schedule 13D to five business days from 10 calendar days for initial filings, with amendments due within two business days, and (ii) Schedule 13G to five business days from 10 calendar days for initial filings by passive investors and other changes for initial filings and amendments depending on the type of filer.

- To account for the accelerated deadlines, the SEC extended the filing date cutoff time for Schedules 13D and 13G from 5:30 p.m. ET to 10 p.m. ET.

- In the adopting release, the SEC issued additional guidance regarding “group” formation for determining whether the 5 percent beneficial ownership threshold triggering a Schedule 13D and Schedule 13G filing had been reached.

- The amendments will be effective and compliance will be required beginning 90 days after publication in the Federal Register, except that (i) the accelerated Schedule 13G deadlines will not apply until Sept. 30, 2024, and (ii) the requirement to use machine-readable data language will not apply until Dec. 18, 2024.

Introduction

On Oct. 10, the U.S. Securities and Exchange Commission (SEC) announced that it adopted final rules amending Sections 13(d) and 13(g) of the Securities Exchange Act of 1934, as amended. The amendments aim to provide investors with more timely information on the positions of key market participants.

The final rules accelerate the filing deadlines for Schedules 13D and 13G, clarify disclosure requirements with respect to derivative securities, require filings to be made with machine-readable data language, and provide additional guidance on other beneficial ownership reporting rules.

Accelerated Filing Deadlines

*As of the date of this article, the amendments have not yet been published in the Federal Register. Based on recent timing for the publication date of a final rule, we would expect these amendments to become effective by late January to mid-February 2024.

Other Requirements and Clarifying Guidance

Structured Data Language

Beginning Dec. 18, 2024, all Schedules 13D and 13G, except for exhibits attached to such filings, will be required to be filed using structured, machine-readable data language. Filings will be submitted through the EDGAR platform using XML-based language.

Derivative Securities

The SEC adopted an amendment to Item 6 of Schedule 13D clarifying that a person filing a Schedule 13D is required to disclose interests in all derivative securities that use the issuer’s equity security as a reference security. This includes cash-settled security-based swaps and other derivatives exclusively settled in cash, in addition to the disclosure requirements already required by Item 6, such as contracts, arrangements, understandings and relationships.

However, the SEC declined to adopt a bright-line rule that deemed certain holders of cash-settled derivative securities as beneficial owners of the reference covered class. The SEC stated that its existing guidance on Rule 13d-3 is applicable to cash-settled derivative securities, meaning that whether holders of security-based swaps and non-security-based swaps that are cash-settled derivatives are considered beneficial owners depends on an analysis of the facts and circumstances.

Group Formation

Lastly, the SEC gave additional guidance regarding when formation of a “group” occurs for the purpose of determining whether the 5 percent beneficial ownership threshold has been triggered. Whether two or more persons are acting as a group depends on particular facts and circumstances. The SEC clarified that the current legal standard in Sections 13(d)(3) and 13(g)(3) applies to shareholder communication such that communications by two or more persons for the purpose of acquiring, holding or disposing of securities of an issuer may be sufficient to constitute formation of a group.

The SEC provided examples of certain actions that would likely not rise to the formation of a group, including (i) shareholders communicating with each other regarding an issuer or its securities but taking no further actions, (ii) engaging in discussions with an issuer’s management without taking any further actions, and (iii) shareholders jointly submitting a nonbinding shareholder proposal to an issuer.

However, the SEC cautioned that if a beneficial owner of a substantial block of a covered class that will be a Schedule 13D filer intentionally communicates to other market participants that its Schedule 13D filing will be made, the engaged parties are likely to be considered a group if the communications had the intention of causing market participants to purchase the same class of covered security.

Effective Dates

The effective date of the amendments will generally be 90 days after they are published in the Federal Register. Based on recent timing for the publication date of a final rule, we would expect the SEC’s new amendments to become effective by late January to mid-February 2024.

However, compliance with the revised Schedule 13G filing deadlines will not apply until Sept. 30, 2024, and with the structured data requirement for Schedules 13D and 13G will not apply until Dec. 18, 2024.

Maggie Sullivan assisted with the creation of this alert.

[View source.]