Introduction

In merger and acquisition (“M&A”) transactions, the definitive purchase agreement (whether asset purchase agreement, stock purchase agreement, or merger agreement) typically contains representations and warranties made by the seller with respect to the target company.[i] The scope and detail of these representations and warranties are often heavily negotiated and tailored to reflect not only the nature of the target and its business, financial condition and operations, but also tend to reflect the relative negotiating strength of the buyer and seller. Representations and warranties not only provide information to the buyer, but also operate to allocate risk as between the buyer and seller with respect to the matters covered by the representations and warranties.

In addition to representations and warranties, M&A purchase agreements generally include indemnification provisions, pursuant to which any given party (“indemnitor”) agrees to defend, hold harmless, and indemnify the other party or parties (“indemnitees”) from specified claims or damages.[ii] These typically include claims arising from a breach of the indemnitor’s representations and warranties or covenants set forth in the purchase agreement, or with respect to other specific matters.

These indemnity obligations are generally subject to various limitations, including with respect to the time limit during which the indemnity is applicable, the amount of damages required to be suffered before the indemnity obligation is triggered (referred to as indemnity “baskets”), and caps on the indemnitor’s indemnity liability.

This article examines how buyers and sellers are negotiating indemnity caps in private company M&A transactions, as shown in the American Bar Association’s (“ABA”) private target deal point studies.[iii]

Indemnification Provisions

A typical indemnification provision in an M&A purchase agreement may read as follows:

Indemnification by the Seller. The Seller agrees to and will defend and indemnify the Buyer Parties and save and hold each of them harmless against, and pay on behalf of or reimburse such Buyer Parties for, any Losses which any such Buyer Party may suffer, sustain or become subject to, as a result of, in connection with, relating or incidental to or arising from:

(i) any breach by the Seller of any representation or warranty made by the Seller in this Agreement or any Additional Closing Document;

(ii) any breach of any covenant or agreement by the Seller under this Agreement or any Additional Closing Document;

(iii) any of the matters set forth on Schedule [___];

(iv) any Taxes due or payable by the Company or its Affiliates with respect to any Pre-Closing Tax Periods; or

(v) any Company Indebtedness or Company Expenses to the extent not repaid or paid, respectively, pursuant to Section [___] and not included in the purchase price adjustment pursuant to Section [___].

An indemnity “basket” and “cap” may be reflected in language such as the following:

Provided that the Seller will not have any liability under clause (i) above:

-

unless the aggregate of all Losses relating thereto for which the Seller would, but for this clause , cumulatively be liable exceeds on a cumulative basis an amount equal to $X (the “Basket”), with the Purchaser remaining liable for such original Basket amount of $X; and

-

to the extent that the aggregate of all Losses for which the Seller would, but for this clause , be liable exceeds on a cumulative basis an amount equal to $Y (the “Cap”);

Provided, further, however, that the Basket and the Cap shall not apply to: (a) any breach of any representations and warranties set forth in Sections [____]; and (2) any breach of any representations or warranties which constitute, or arise from or relate to, fraud on behalf of the Company or the Seller.

The Parties Positions on Indemnity Caps

Because the representations and warranties of the target company (or selling stockholder(s), as applicable) are likely to be much more extensive than the typically limited representations and warranties of the buyer, the buyer is more likely than the seller to be the indemnitee and beneficiary of indemnity, and thus has an interest in keeping any limitations on indemnity to a minimum. The seller/indemnitor, of course, has the opposite interest: to limit the circumstances in which it will have indemnity liability to the buyer or any other indemnitee.

An indemnity cap is one typical limitation on indemnity liability in private company M&A transactions. While a cap is commonplace in M&A agreements, so are exceptions to the cap (i.e., situations where the cap on indemnity does not apply). The most common exceptions to an indemnity cap relate to the indemnitor’s breaches of its most critical, or “fundamental” representations or of its covenants or agreements. The former exception recognizes that as to those subject areas which are critical to the overall risk allocation between the buyer and seller, the seller/indemnitor should “stand behind” its representations and warranties without limitation. The best example relates to title to the assets or equity being acquired. A buyer will argue, not unreasonably, that if the seller’s representations as to ownership of the assets or equity being acquired are untrue, the seller should have full liability for any damages the buyer incurs due to defects in title. The latter exception – as to covenants – is based on the understanding that whether or not a party’s covenants are breached is fully within the control of that party. Thus, the breaching party should not be permitted to use the indemnity cap as a shield but, instead, should be required to perform its obligations as stipulated in the agreement. One common example is the seller’s non-competition covenants, whereby the seller agrees not to compete, following the closing, with the business being sold. From the buyer’s perspective, the seller should be forced to comply with its agreement not to compete, and should not have an option to compete “liability free” above an indemnity cap.

Trends in Indemnity Caps

Every other year since 2005 the ABA has released its Private Target Mergers and Acquisitions Deal Point Studies (the “ABA studies”). The ABA studies examine purchase agreements of publicly available transactions involving private companies that occurred in the year prior to each study (and in the case of the 2017 study, including the first half of 2017). These transactions range in size but are generally considered as within the “middle market” for M&A transactions; the average transaction value within the 2017 study was $176.3 million.

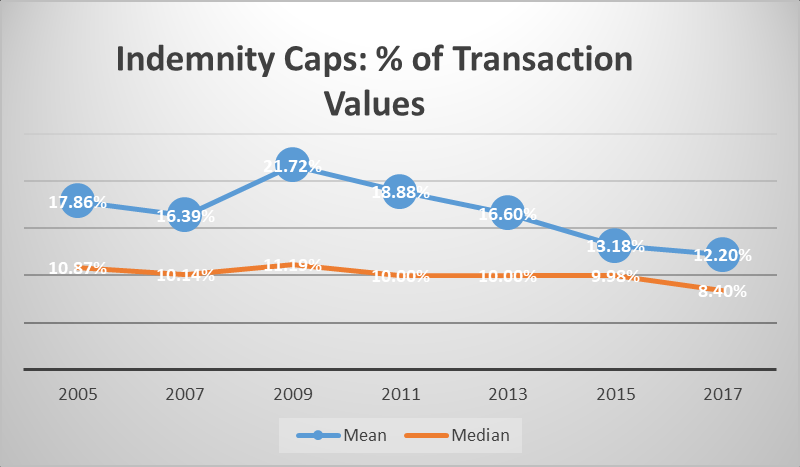

Over the seven ABA studies (2005-2017), indemnity caps have declined [HA1]as a percentage of transaction value (whether as mean or median). This decline has been fairly consistent over the period of the ABA studies despite an uptick in the mean of indemnity caps following the financial recession of 2008 that was almost certainly the result of the private company M&A market being “buyer friendly” during this time period.

For reference, the mean represents the average of all of the covered data, and the median represents the data point separating the lower and higher halves of the overall data (i.e., one-half of all data points are above and one-half are below the median). Median is often considered a more reliable indicator of what is “normal or typical” where data distribution is skewed.

The Role of Representation and Warranty Insurance (RWI) in Indemnity Caps

One of the biggest changes in the private company M&A industry during the past decade has been the enormous growth of representation and warranty insurance (“RWI”). With RWI, buyers and sellers are able to allocate some of the post-closing M&A indemnity risk to third party insurers. Within the past 7-10 years, RWI has gone from being a differentiator that aggressive buyers offered to a much more common feature of private M&A deals. As indemnity risk has been shifted through RWI from sellers to third party insurers, avenues for a buyer’s indemnity recourse against sellers have narrowed, including through the lowering of indemnity caps and even the elimination of post-closing seller indemnity for representations and warranties (subject to narrow exceptions, such as in the event of fraud).

Kirk Sanderson, Managing Partner of M&A Insurance Solutions in New York, explains:

“When the product became available about 10 years ago, buyers primarily purchased R&W [insurance] as supplemental indemnity coverage when they were unable to get sellers to provide what they considered to be adequate indemnification protection under the transaction agreement. But in today’s market, sellers are essentially mandating that buyers take a reps and warranties policy to remain competitive in an auction scenario while providing very limited or no post-closing indemnification for seller representations and warranties to buyers.”

The most recent ABA Study in 2017 was the first to review the use of RWI in private M&A transactions. While that topic generally is beyond the scope of this article (and is the subject of a separate article[HA2] in this series), the ABA study did consider the relationship between indemnity caps and deals that referenced RWI in in the transaction documents.[iv]

As illustrated below, the 2017 ABA study showed that indemnity caps were lower in reported deals where RWI was referenced in the deal documents, as compared with transactions without any such reference.

|

2017 Indemnity Cap

|

Overall

|

No RWI Reference

|

RWI Reference

|

|

Indemnity Cap Mean

|

12.20%

|

14.70%

|

5.77%

|

|

Indemnity Cap Median

|

8.40%

|

10.00%

|

1.00%

|

Conclusion

Indemnity caps are often one of the most intensely negotiated provisions of an M&A purchase agreement. The market amount for indemnity caps has historically been a direct reflection of the relative strength of buyers and sellers in the private company M&A market. Most recently, however, the growth of RWI has had a dramatic impact in lowering indemnity caps, and this trend is expected to continue and stabilize.

[i] Note that within this article I use the terms “seller” and “target” in the context of a stock purchase transaction—the “seller” would be the selling shareholder(s) making the representations and warranties in the M&A documents, and the “target” would be the company being acquired. In an asset purchase transaction, the “seller” would be the target company itself but, for consistency, I am using “seller” and “target” in a stock purchase setting. In addition, the terms “target” and “Company” are used interchangeably.

[ii] There are technical distinctions between a duty to defend, on the one hand, and the duty to indemnify, on the other hand, but we use the reference to indemnity or indemnification as encompassing both concepts within this article.

[iii] This article looks at indemnity caps in U.S. private company M&A transactions only. It does not, for example, examine other types of transactions or public company M&A transactions.

[iv] Relying on references to RWI in M&A transaction documents as evidence of RWI’s usage is potentially imperfect. In the author’s experience, sellers may insist that they have minimal involvement or “connection” with the RWI insurer or the RWI process, and that the buyer deal with indemnity risk wholly on its own, whether through RWI, self-insuring, and/or negotiations with the seller in the M&A documents This approach is driven at least partly by the concern that if faced with claims, insurers may seek third party beneficiary, subrogation, privity or other means of recourse against the seller (notwithstanding language in the documents to the contrary), and the view that reducing any documentary connections with, or even references to, RWI could assist in a seller defense against such insurer claims. In addition, where the seller, and not the buyer, is acquiring the RWI policy, one would expect there to be no need to reference the policy in the M&A documents (though those situations would likely not see a reduction in seller indemnity caps). In other words, it is possible that some meaningful number of M&A deals with RWI have no references in the deal documents to the insurance policy itself.

[HA1]Insert chart as a hyperlink in BLAW version

[HA2]Link to article